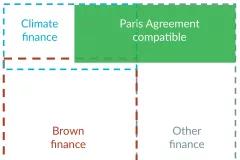

Driving deep decarbonisation with climate resilient infrastructure in line with the Paris Agreement will require massive investment in climate solutions. Current investment flows are however not consistent with either global climate or sustainable development objectives. Debates around sustainable finance today will play a key role in shifting financial flows that will have important implications for emissions patterns and progress for decades to come. Urgent action is needed to foster enabling environments for Paris-aligned investments, phase-out investments in high-emissions activities and thereby avoiding further stranded assets. A deeper understanding of transition finance needs at the country and sector level is an important element to facilitate climate-aligned finance; as well as the implementation of effective finance and de-risking mechanisms and policy change to mobilise sufficient transitional investment from private and public sources.

Our interdisciplinary team combines global insights with in-country development cooperation and technical expertise to support policy makers, investors, business, and civil society to:

- Develop criteria and tools for Paris-aligned investment decision making

- Support reforms and development and implementation of climate strategies in public and development finance organisations

- Track and analyse finance sector climate initiatives and their impact

- Analyse climate risk, especially transition and high carbon lock-in risk

- Analyse national and sectoral investment and transition finance needs

- Analyse effective finance instruments and enabling policies