Passive investing is on the rise, but retail investors should be aware of the differences in the way asset managers handle corporate stewardship and choose an asset manager that aligns with their values to ensure that passively invested capital is not supporting carbon-intensive business models.

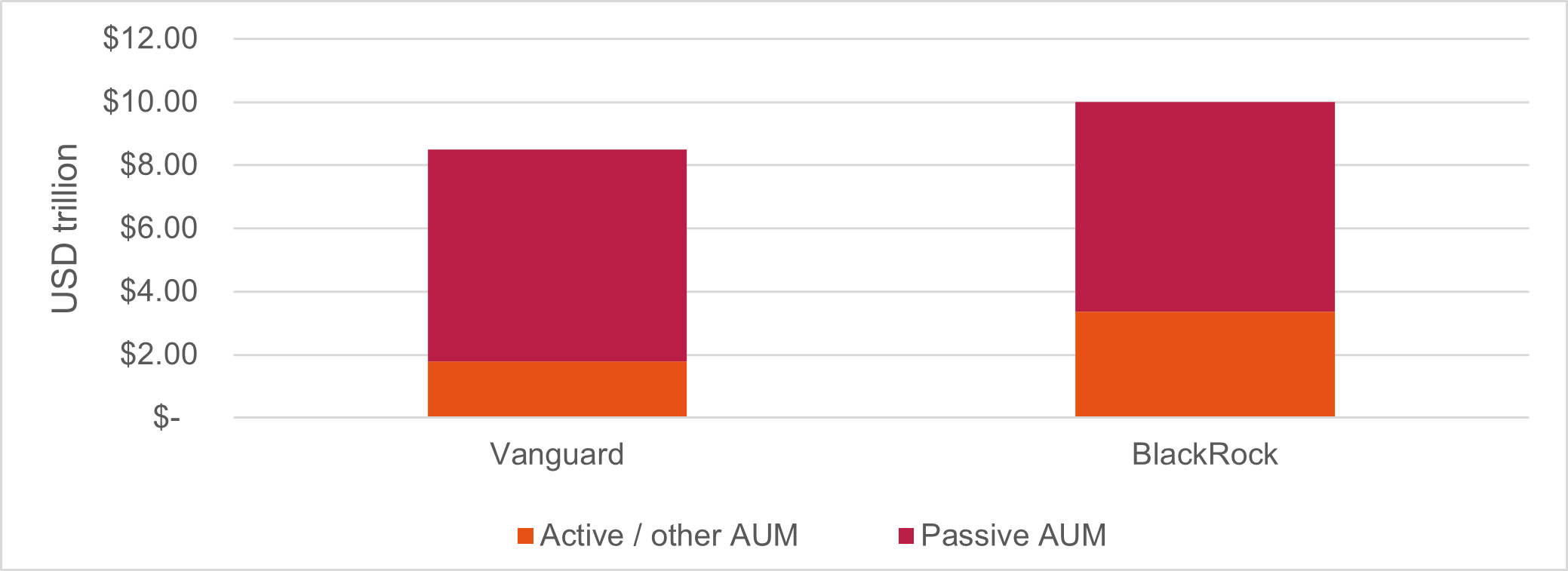

Passive investing is on the rise (see Figure 1) for good reason. With low costs and well-diversified options like Exchange Traded Funds (ETFs), it is no wonder that many investors are turning to passive investment products. However, as more and more investors jump on the passive bandwagon, it is important to remember that not all passive investment options are created equal. This has important consequences for climate conscious investors.

Figure 1: Assets under management (AUM) in 2021, by management style. Based on Vanguard and BlackRock, latest publicly available data used.

When it comes to choosing a passive investment option, many investors base their decision solely on cost, availability , and prospective financial returns. But when you look into how passive investment funds are managed, there is a lot more to consider than just the bottom line. Asset managers have a responsibility to act in the best interest of their clients, but (retail) clients often have limited knowledge of, and influence on, how this responsibility is carried out.

Not only for climate-conscious investors, the right choice of asset manager is crucial, as supporting carbon-intensive business models through passively-invested capital also bears financial transition risks in an increasingly decarbonising world. While mutual funds give asset managers more control over the composition of their funds, index-tracking funds prescribe a fixed fund composition. But even in the case of index-tracking funds, asset managers can still have influence. Through direct engagement with the companies that are part of the indices, as well as through proxy voting on behalf of asset owners, asset managers can have influence on funds climate impact. Asset managers can also exert pressure on index providers to exclude certain companies and apply weights when replicating the index. Retail investors, however, often lack the tools to adequately communicate engagement priorities, leaving asset managers with an unclear or non-representative mandate for investment stewardship.

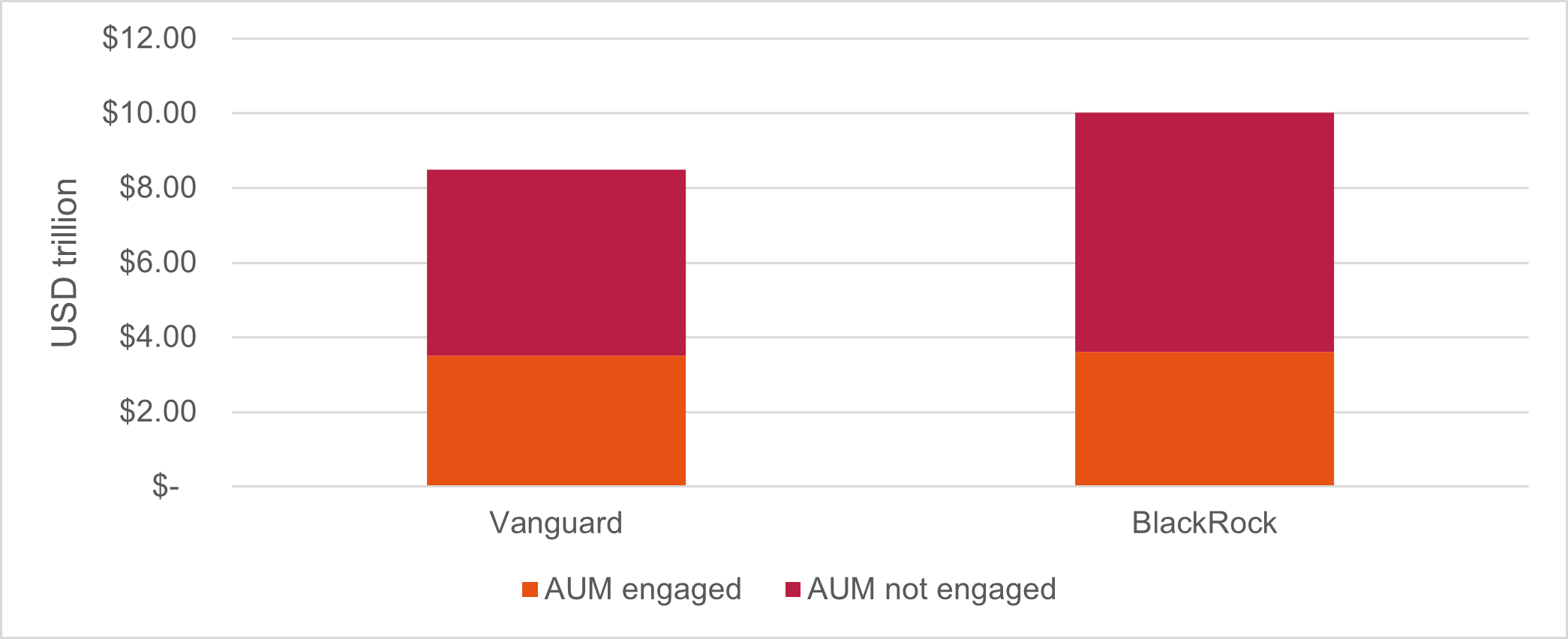

Not all asset managers will engage to the same level with investee companies. A look at engagement statistics and proxy voting records of major asset managers like BlackRock and Vanguard shows that they only engage a small share of their assets under management (see Figure 2).

Figure 2: AUM by engagement coverage in 2021. Based on Vanguard and BlackRock, latest publicly available data used.

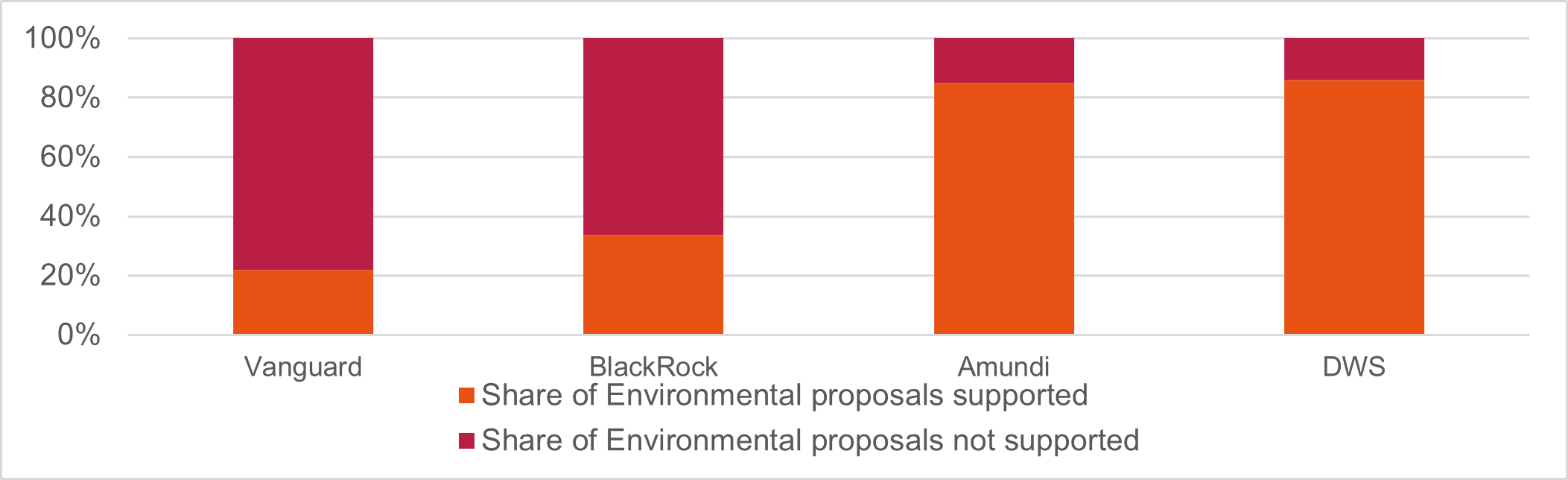

There are also stark differences in the level of environmental scrutiny that asset managers apply through their proxy voting. Some of the largest asset managers, such as Vanguard and BlackRock, tend to deny support for most environmental proposals presented to investee companies (see Figure 3). While these statistics do not say much about the ambition or integrity of the environmental proposals at question, there is a clear regional discrepancy when compared to the proxy voting behaviour of European asset managers, such as Amundi and DWS.

Figure 3: Proxy voting on environmental proposals in 2021. Based on Vanguard, BlackRock, NZAMI, and DWS and DWS, latest publicly available data used.

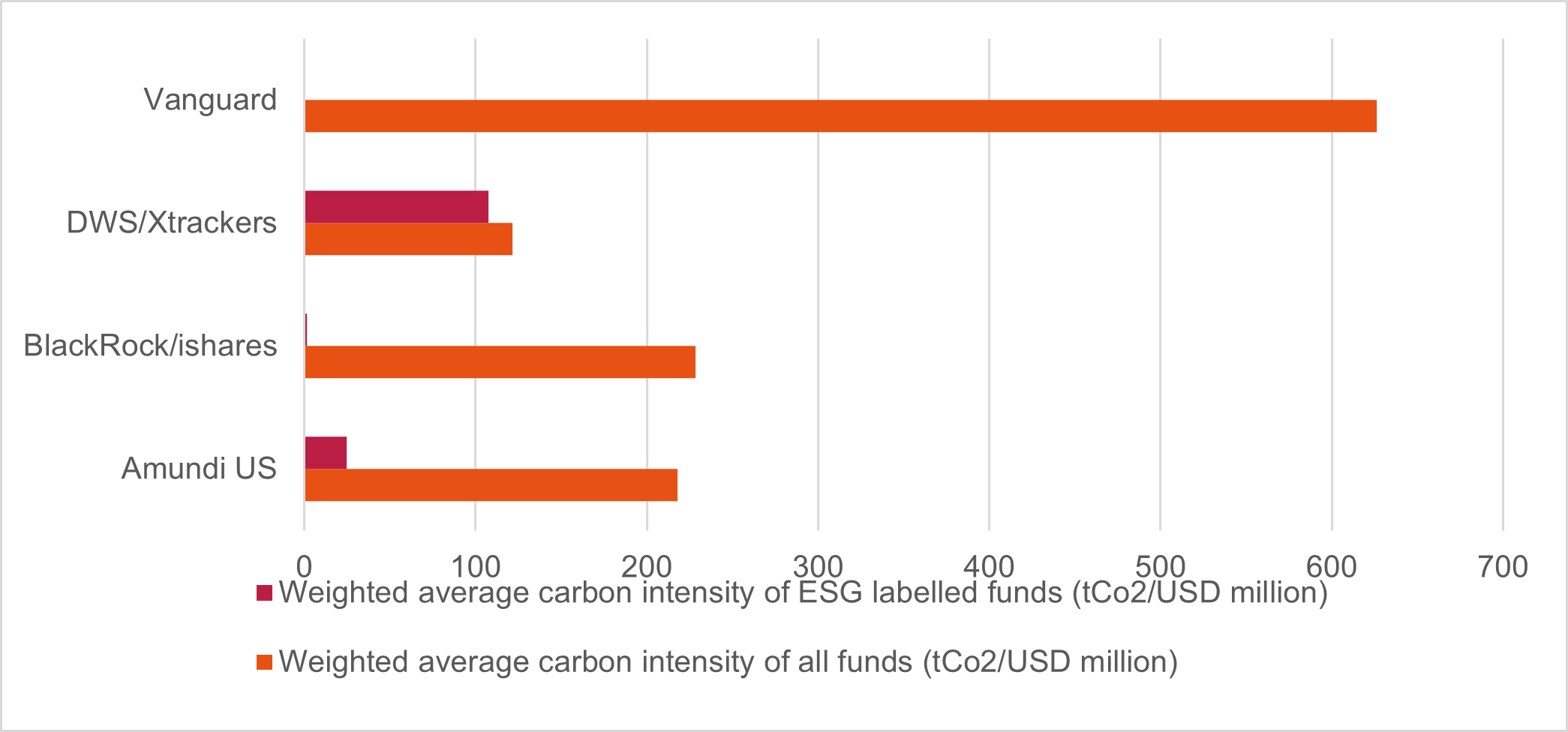

And while many asset managers offer dedicated funds for climate-conscious investors, such as dedicated ESG-themed active and passive investment products, these funds do not always live up to their promise. ESG labels lack common standards, and what different asset managers consider to be good environmental, social, or governance characteristics can vary greatly. This is highly problematic as investors tend to be misled by ESG labels in thinking that underlying companies are sustainable.

Figure 4: Comparison of the average carbon intensity of funds of different providers. Based on Fossil Free Funds.

When it comes to passive investing, it is important that also retail investors do their research and choose an asset manager that aligns with their values. This requires asking the right questions and selecting an asset manager that offers the appropriate responses. While passive investing is affordable and can generate consistent returns, investors put their stewardship powers into the hands of large financial institutions that may not share values that are representative of clients’ moral code and interest.

Investors must actively demand that asset managers act in their interest.