Climate has arrived on the financial world’s agenda – ambition is still a question

Climate change has clearly arrived on the financial world’s agenda. The number of asset owners and asset managers joining international climate initiatives is growing, and financial institutions increasingly set dedicated climate targets. Of the 50 largest asset managers and asset owners, 90% and 30% of these assets respectively are under a net zero or carbon/climate neutrality target.

GFANZ, the Glasgow Financial Alliance for Net Zero was founded in 2021 as an umbrella for a number of initiatives within the broader financial landscape under the “Race to Zero” campaign. Already less than one year after its founding, GFANZ’s membership has grown rapidly to include a significant share of global assets under management but GFANZ’s direct link to the Race to Zero campaign has been severed over tensions regarding the ambition of respective membership criteria. The apparent trade-off between ambitious climate criteria and retaining broad participation is a challenge that raises questions around the potential impact of the alliance.

Net zero portfolio targets are not the right instrument for 1.5°C

The indirect link between investors, capital markets, companies, and polluting activities, means that exactly how an investor’s decisions affect actual emissions levels in the real economy remains poorly understood. Net zero or related targets on the portfolio level, are generally not an accurate reflection of the important potential role that financial institutions can have as financiers of the rapid transition the world needs.

At the same time, the increasing concentration of decision-making in capital markets, accelerated by the passive investing trend, means that especially the largest asset managers have an outsized influence on companies’ access to capital and their climate strategies. The largest asset managers and asset owners have become “universal owners”, with portfolios exposed to a significant portion of all global assets. Their broad exposure means that universal owners’ interests have become synonymous with stable economic growth around the world, to which climate change poses a direct threat. As such, it should be in the interest of universal owners to ensure that the emissions intensive parts of their portfolios shift to mitigate the threat of climate fuelled value destruction on their overall portfolio. Despite the growth in target setting, inertia has meant that asset managers and asset owners have not yet meaningfully moved to pressure their high-emitting investee companies to shift towards a decarbonisation pathway.

It is essential that investors take advantage of the leverage they have

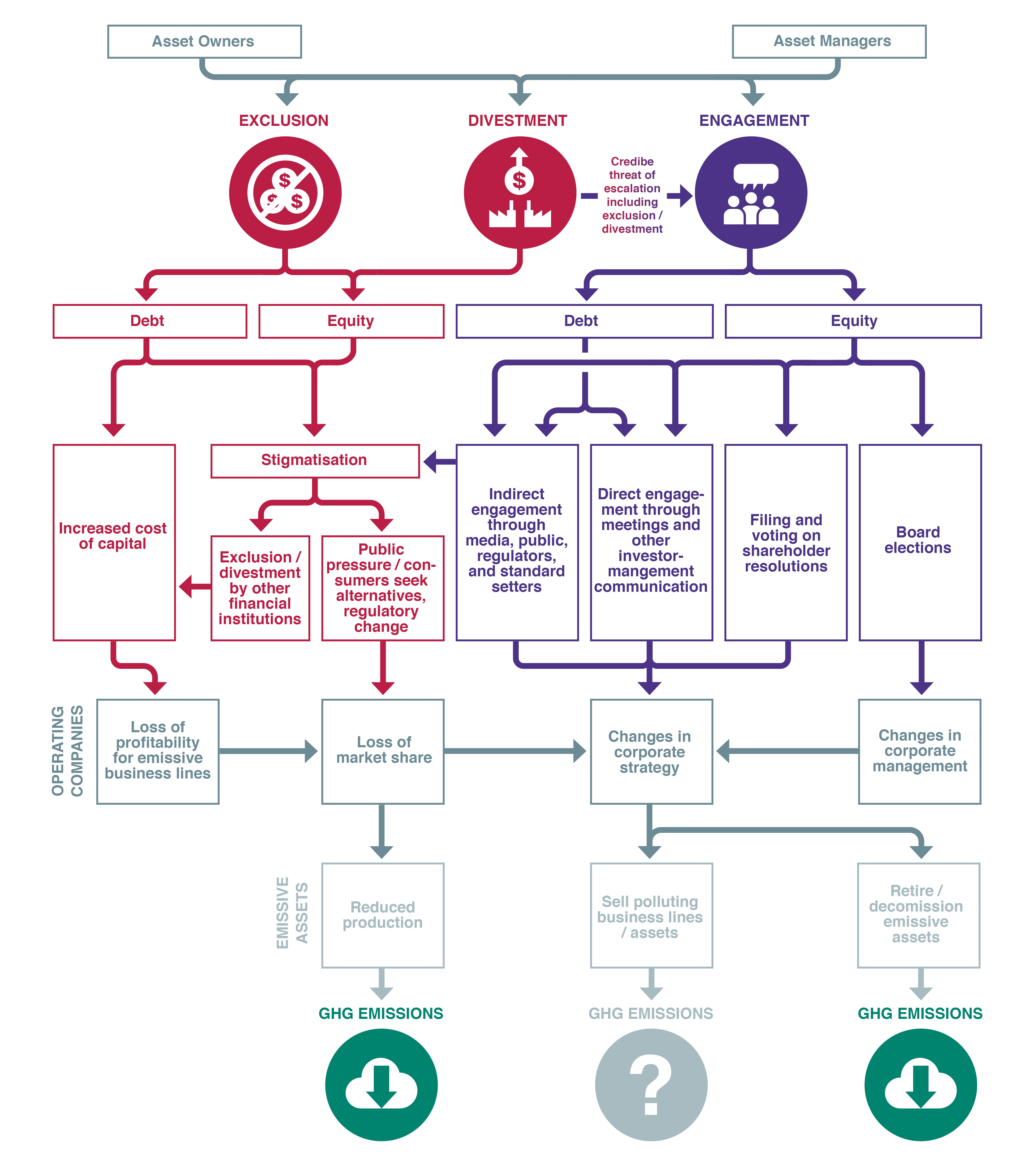

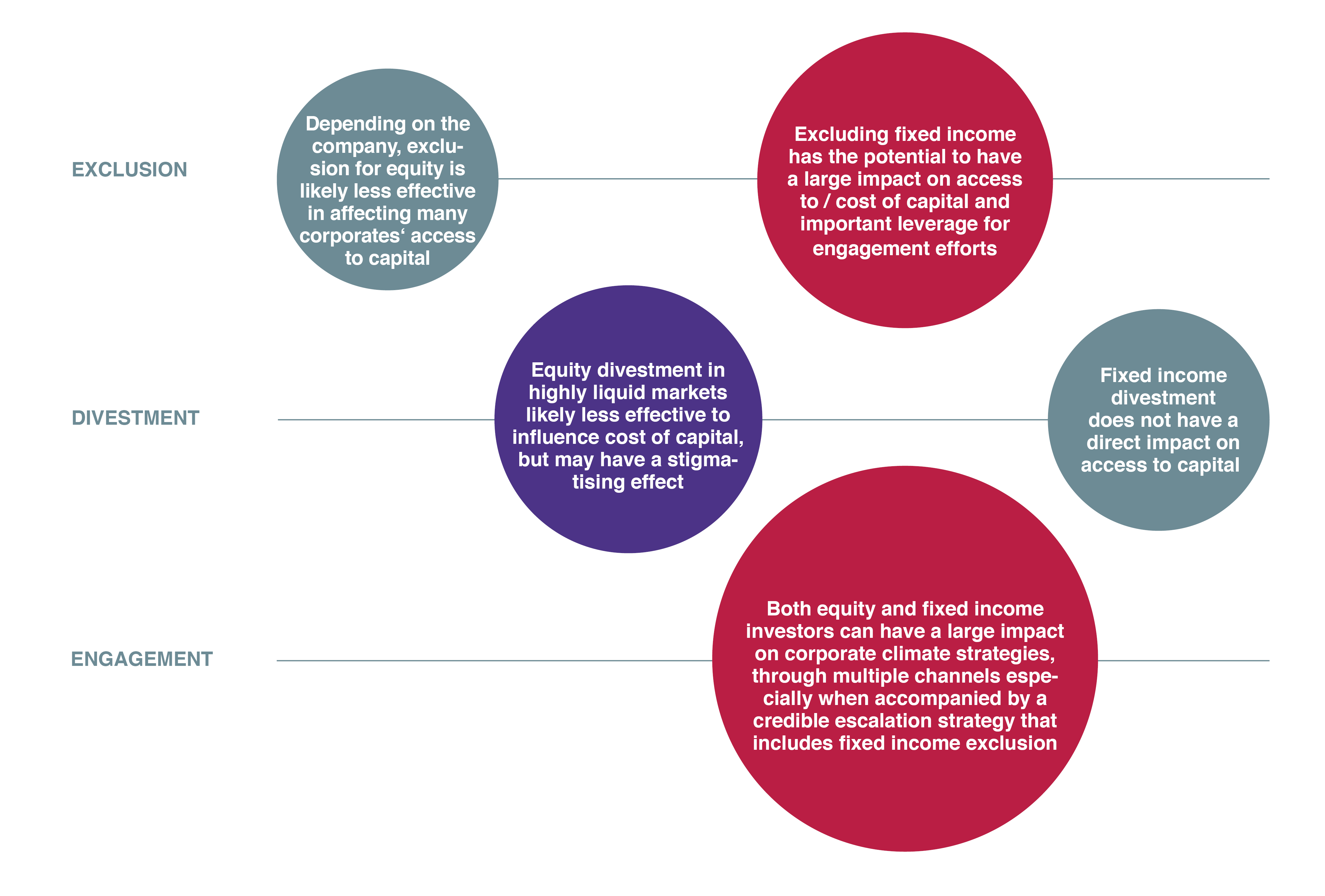

Asset owners and managers have three main channels to influence emissions in the real economy: exclusion, divestment, and engagement (see Figure 1). Interrelated and potentially mutually reinforcing, their potential to support increased climate action in both debt and equity markets are underutilised. In order to make financial flows consistent with the Paris Agreement, asset owners and managers need to take much more advantage of the leverage they have (see Figure 2).

- Exclusion, and particularly the ability to deny companies’ ability to roll over the large amount of bond debt that will mature in the current “critical decade”, gives institutional investors significant control over corporates' access to capital. This control also means that institutional investors have significant leverage when engaging with companies on their climate strategies. Currently, however, only about 50% of the 50 largest asset managers and less than 20% of the largest 50 asset owners have climate-relevant exclusion policies, and most exclusion policies have large gaps in coverage or have other loopholes.

- Divestment in equity and fixed income markets may help insulate investors from future stranded assets but has only an indirect impact on the cash flow of companies, especially in liquid markets, given the continued number of neutral investors. The stigmatising impact of divestment campaigns may however have an indirect effect depending on a number of geographical and media-related factors. Less than 10% of the largest 50 asset managers and largest 50 asset owners have divested from emissions-intensive assets or made climate-relevant divestment commitments to date.

- Although hard to measure with objective criteria, engagement efforts are likely generally underutilised. While activist investors have started to engage in climate issues on corporate boards and in annual shareholder meetings, their success largely depends on their ability to convince and mobilise a critical mass of larger institutional shareholders to support their efforts. The high cost of understanding and forming a position as a basis to engage with many thousands of companies is a challenge for most institutional investors, which has made them highly reliant on the research and recommendations of proxy advisors. The recommendations of these proxy advisors are often likely not in line with the overall international climate commitments of institutional investors and institutional investors could benefit by more clearly communicating their climate commitments to proxy advisors and growing their in-house engagement teams to better identify opportunities to influence corporate climate strategy development and implementation.

Given the urgency of action in this critical decade, it is in everyone’s interest – including the largest asset owners and managers – to rapidly ramp up use of these strategies to help corporates realise the business opportunities to be found in deep decarbonisation and avoid the worst impacts of climate change.