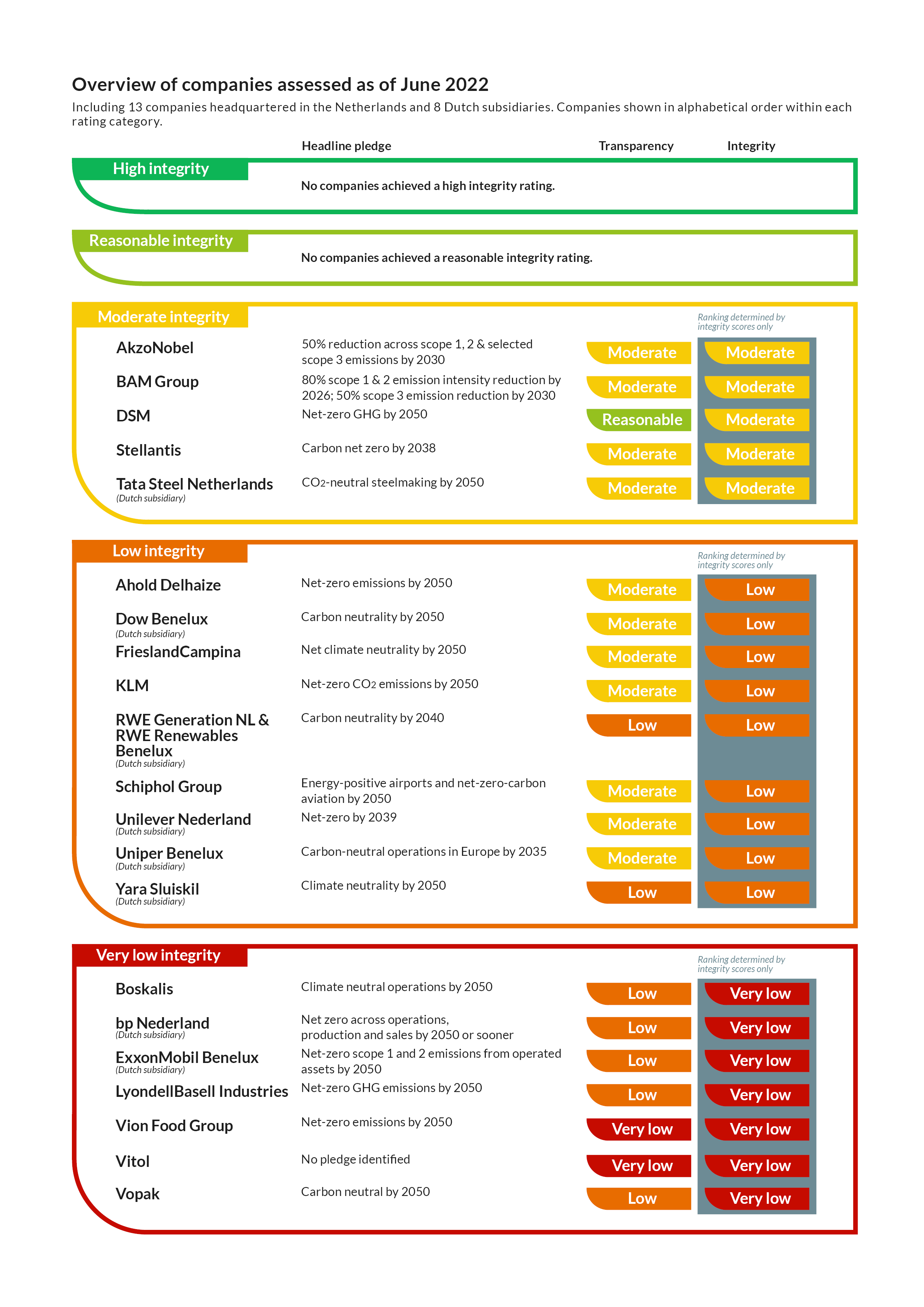

An assessment of the climate action plans of 29 Dutch companies and financial institutions

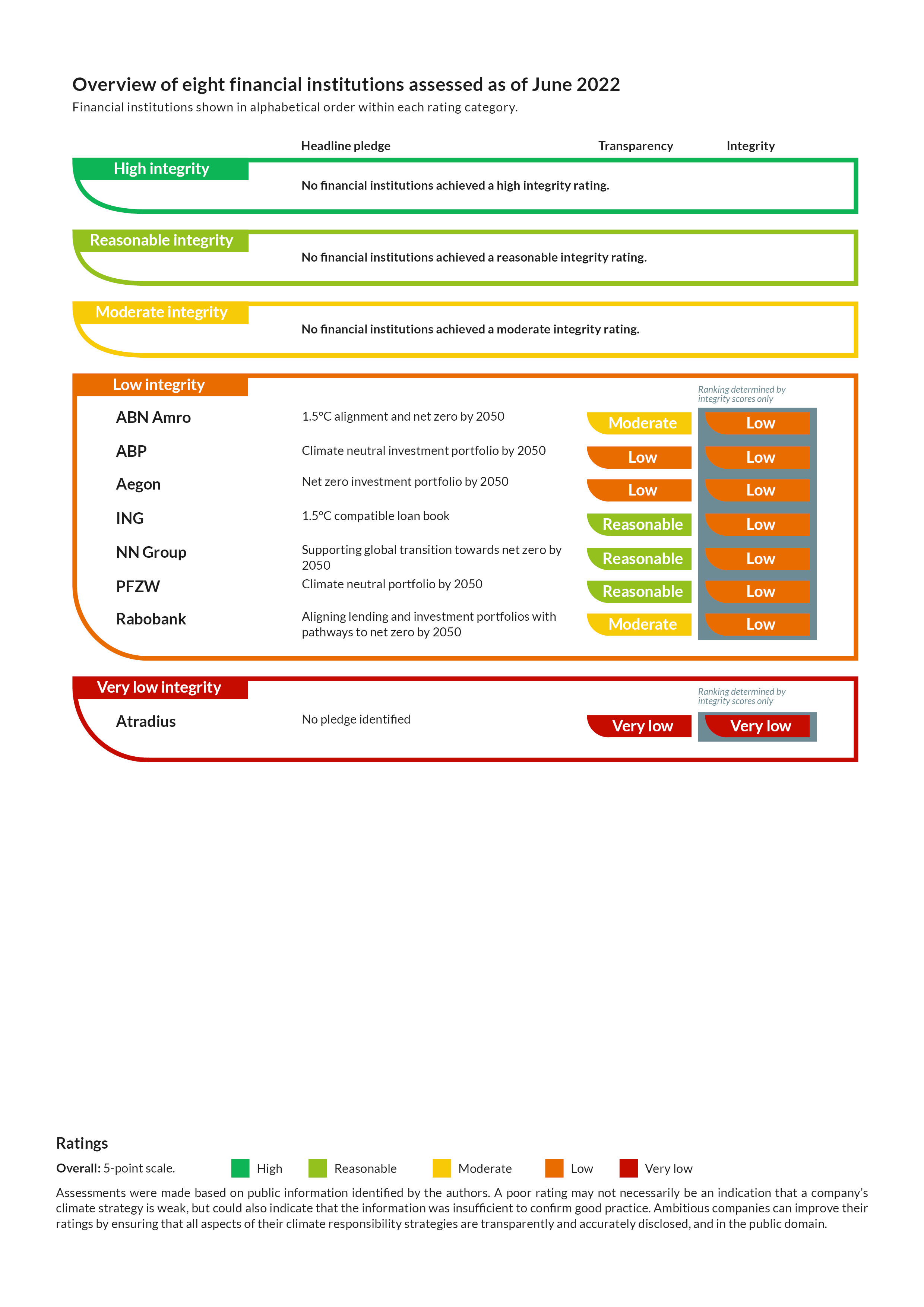

In this publication, we scrutinise the climate pledges of leading corporations active in the Netherlands. We review the targets and actions of 29 companies: eight financial institutions and 21 businesses with their main activities in the ‘real economy’. Our company assessments focus on the ambition and action underlying their public claims and promises related to the climate impact of their activities with a focus on both their transparency and overall integrity.

A number of leading Dutch companies and financial institutions are currently falling short when it comes to setting and implementing ambitious targets that align with the global goal to avoid the most damaging impacts of climate change.

None of the 21 companies and eight financial institutions in this report achieved a high or even reasonable integrity rating for their approaches to setting and implementing climate targets. Just five companies, AkzoNobel, BAM Group, DSM, Stellantis and Tata Steel Netherlands, achieved a moderate integrity rating. The majority of companies fall in the low or very low integrity categories. Seven of the financial institutions achieved a low integrity rating, while Atradius, which provides no climate targets and plans at all, achieved a very low rating.

The 21 companies we assessed commit on average to reduce emissions by just 19% (median 10%), which is well short of the collective goal to halve emissions by 2030 needed to avoid global temperate rise of 1.5°C. There is also a lack of clarity on companies’ long-term targets. While most of the companies pledge to achieve net-zero emissions beyond 2030, only two explicitly state that they will reduce emissions across their value chain by at least 90%. Several companies with a net-zero pledge are active in sectors that are highly emission-intensive by nature, for instance: oil; fossil gas; meat; and synthetic nitrogen-based fertilisers. It is contentious whether producing and consuming those products can align with the Paris Agreement objectives. Pledges to decarbonise only the production of goods may give consumers, shareholders, and regulators an inaccurate impression of the prospects for decarbonising an inherently emissions-intensive industry.

None of the companies present concrete and publicly accessible emission reduction plans that place them on a Paris-compatible decarbonisation pathway. The existing plans and reduction measures are insufficient to realise deep emission reductions, or they do not address key emission sources. Some companies undermine their own reduction efforts by continuing to lobby for the expansion of carbon-intensive infrastructure.

Click here for the high resolution image.

The eight financial institutions reviewed in this report have not yet adopted comprehensive exclusion or engagement policies. While the financial institutions’ exclusion policies differ in their coverage and stringency, all evaluated institutions continue to directly or indirectly finance fossil fuel value chains. Most also continue to provide financial services for other harmful activities, such as unsustainable agriculture. Further, all of the companies need to develop clearer, more comprehensive and targeted approaches to engage with companies in all relevant sectors on their shift towards Paris-aligned business models.

Click here for the high resolution image.

This report was prepared with v2.0 of the Guidance and assessment criteria for good practice corporate emission reduction and net-zero targets. The most up to date version of this methodology is v3.0 (published February 2023).