Private financial institutions (FIs) play a pivotal role in global decarbonisation through their influence on where and how capital is allocated. However, FIs' voluntary climate approaches have faced criticism for the disconnect between their public commitments, which are often centred on misleading portfolio-level net-zero targets, and continued investments in fossil fuels. Voluntary cooperative climate initiatives (CCIs) seeking to amplify FIs’ climate efforts have shown limited success, raising concerns about the capacity and incentives for FIs to drive credible climate action without supportive regulatory and market environments.

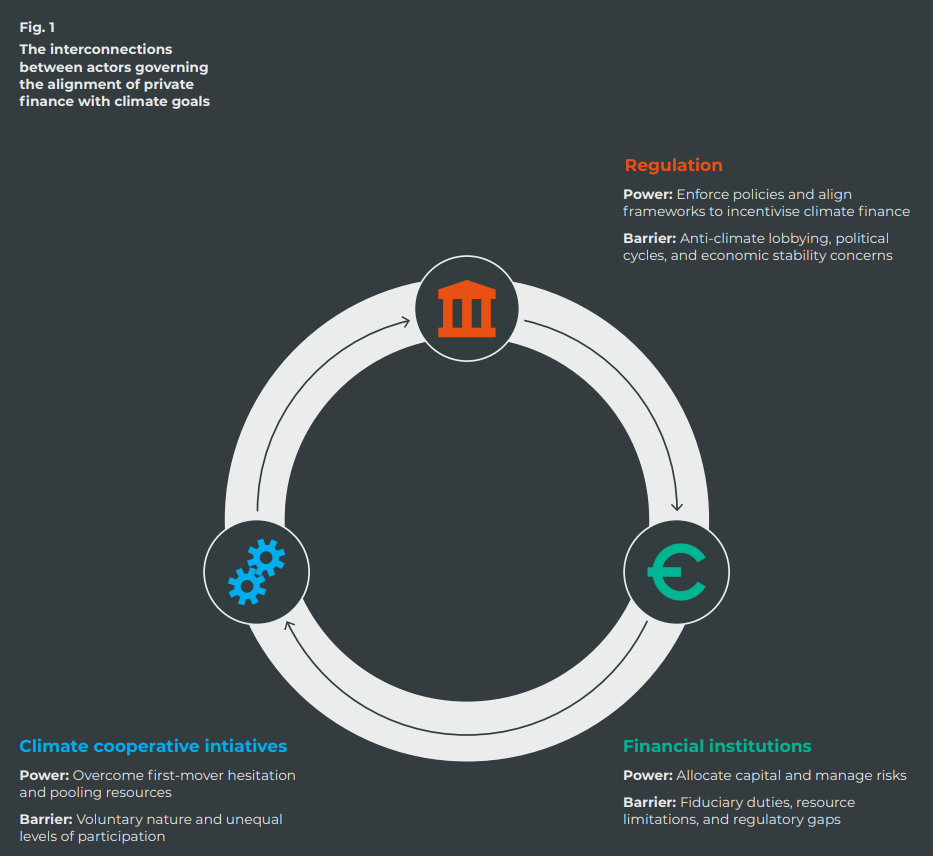

To address this challenge, this report presents the framework of "impact levers" to map how each key actor within the governance chain (FIs, CCIs, and regulators) can achieve meaningful alignment between their current practices and real-economy climate goals. At the institutional level, we assess how banks, asset managers, and pension funds can align capital allocation with climate goals while navigating profit-maximising mandates. At the CCI level, we examine how coalitions can move beyond voluntary pledges toward enforceable standards and legal adoption pathways. At the regulatory level, we investigate mechanisms for embedding systemic climate risks into financial decision-making to drive accountability and shift markets toward Paris-aligned pathways.

Our findings reveal that while net-zero methodologies dominate the financial sector’s approach to climate alignment, action-oriented strategies remain underutilised. Through the lens of the impact lever framework, we derive a set of actor-specific recommendations, identifying both low-hanging fruit and more ambitious, higher-impact actions.

Key insights include:

- The climate governance chain in the financial sector is fundamentally broken. Despite growing awareness of climate risks and an increasing number of net-zero commitments, the sector remains structurally unfit to support a transition to a Paris-aligned economy. The key actors within the governance chain, which include financial institutions (FIs), climate cooperative initiatives (CCIs) and regulators, have thus far failed to deliver the coordination, ambition and accountability needed. In its current form, the financial sector is unlikely to align with the Paris Agreement, let alone act as an enabler of the low carbon transformation.

- The symptoms of this breakdown are already visible. Financial institutions continue to channel capital into high-emissions sectors, with an estimated USD 3.7 trillion annually flowing into fossil fuels like oil, gas and coal. Climate cooperative initiatives (e.g. GFANZ) have largely failed to translate pledges into tangible decarbonisation outcomes in the real economy. Regulators and market environments, even in jurisdictions with greater attention to climate change, have not created the incentives and rules necessary to promote a shift to Paris-aligned finance. In some jurisdictions, climate alignment in the financial sector is even actively undermined.

- Each actor in the governance chain bears responsibility for aligning financial strategies, portfolios and capital flows with the transition to a net-zero, climate-resilient economy. Structural barriers, such as the difficulty of pricing long-term climate risks and the challenges of coordinating collective action, can be addressed through complementary levers across the governance chain. Climate cooperative initiatives can mobilise and coordinate voluntary action, while regulators are positioned to correct market failures and establish effective incentives through targeted interventions.

- To repair the broken climate governance chain, all actors must activate the levers within their discretion to overcome structural barriers, coordinate ambition and enforce accountability. To support that effort, this report examines the limitations of current climate governance in the financial sector and explores how financial institutions, climate cooperative initiatives and regulators can better align their actions with the goals of the Paris Agreement. It maps the key levers available to each actor, highlights where these remain underdeveloped, and provides a structured framework for action, ranging from minimum to high-ambition strategies, to guide more effective climate governance.

This report was published as part of the ACHIEVE project. ACHIEVE is a Horizon Europe project that aims to strengthen and scale up high-integrity voluntary climate action towards achieving net-zero emissions by mid-century.