Decarbonising the power sector is a key step on the road to net zero as it will cut both power sector emissions and help push fossil fuels out of the buildings, transport and industrial sectors as these sectors electrify.

To help track global and country level progress, the Climate Action Tracker has established benchmarks for the shares of fossil gas, coal and renewable energy in the power sector that are compatible with limiting warming to 1.5°C. We have set out these benchmarks in a separate report, Clean electricity within a generation, and in this briefing we use them to look at how close countries are to achieving them.

Decarbonise the power sector by 2040 – within a generation.

Developed countries need to phase out coal by 2030, and unabated gas by 2035. The developing country power sector transition is not far behind, phasing out both coal and fossil gas by 2040, many with financial support. This represents a transition to global clean power within a generation.

Key to achieving clean power is the acceleration of renewables deployment. All countries achieve above 80% of electricity from renewables by 2035 in these 1.5°C aligned benchmarks, and 90-100% renewable electricity supply by 2050.

There is no role for carbon capture and storage (CCS) in coal generation, and a marginal role for fossil gas equipped with CCS, at best. The future of fossil fuels in a 1.5 ̊C compatible power sector transition, whether abated or unabated, is the same – one of swift decline.

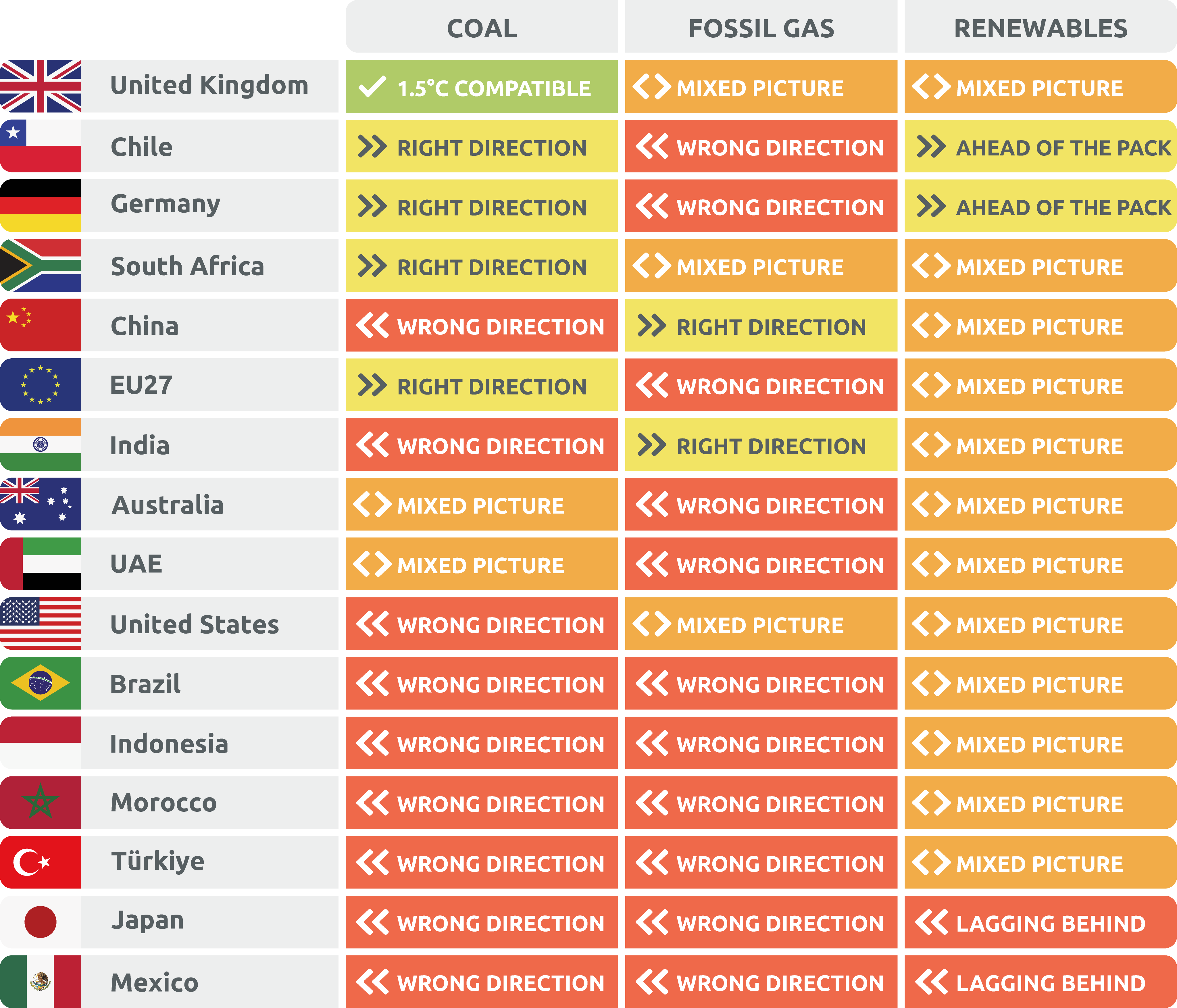

In this briefing, we present 1.5°C benchmarks for 16 countries - Australia, Brazil, Chile, China, EU27, Germany, India, Indonesia, Japan, Mexico, Morocco, Türkiye, South Africa, United Arab Emirates, the UK, and the US – and assess whether they are on track to meet them.

No country we assessed is fully on track for this power shift, but there are some positive signs:

- The UK is on track to phase out coal by 2024 - which is on a 1.5°C compatible timeline, with the EU, Germany, Chile and South Africa heading in the right direction. Brazil could get on the right track if it repealed Bolsonaro-era legislation.

- The US and the UK’s 2035 power sector decarbonisation targets are in line with the needed unabated fossil gas phase-out by that time, but both need to do more to achieve them

- India and China have 1.5°C compatible levels of fossil gas power now, but both need to develop their longer-term phase-out strategies.

- Germany and Chile are ahead of the pack in terms of renewables deployment. While the sector is booming elsewhere (China, India), it is still not fast enough for the speed of fossil phase-out needed.

There is still plenty to worry about:

- No country we analysed has an explicit fossil gas phase-out plan and the fossil gas pipeline is now larger than the pipeline for coal

- While the global coal pipeline outside of China is shrinking, China’s coal plant permitting spree is a cause for concern. If it continues, the only way to avoid a major increase in emissions would be to drastically cut power plant utilisation.

- Most countries are not doing enough to accelerate the renewable energy transition, with Japan and Mexico at the back of the pack.

- The UAE has called for an emissions phase-out rather than a fossil fuel one. Our analysis shows that CCS will play a minimal role in fossil gas power (and none at all in coal). As incoming COP President, the UAE can make a significant impact on climate ambition by securing global agreement to phase out fossil gas by 2040 globally and lead by example by doing so at home by 2035.

Climate finance will be key to meeting the 2040 global phase-out. The handful of Just Energy Transition Partnerships (JETPs) developed to date are a step in the right direction, but insufficient. Countries like Morocco, who are heavily reliant on coal power today, but have huge renewable energy potential, will need international support to ensure a swift transition.

On the eve of the Climate Ambition Summit, it is clear that all governments need to do more. We will be watching.

For more information on progress and the latest developments on a fuel and country level, please read the report in full.