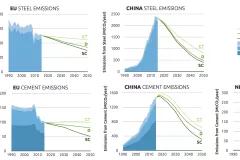

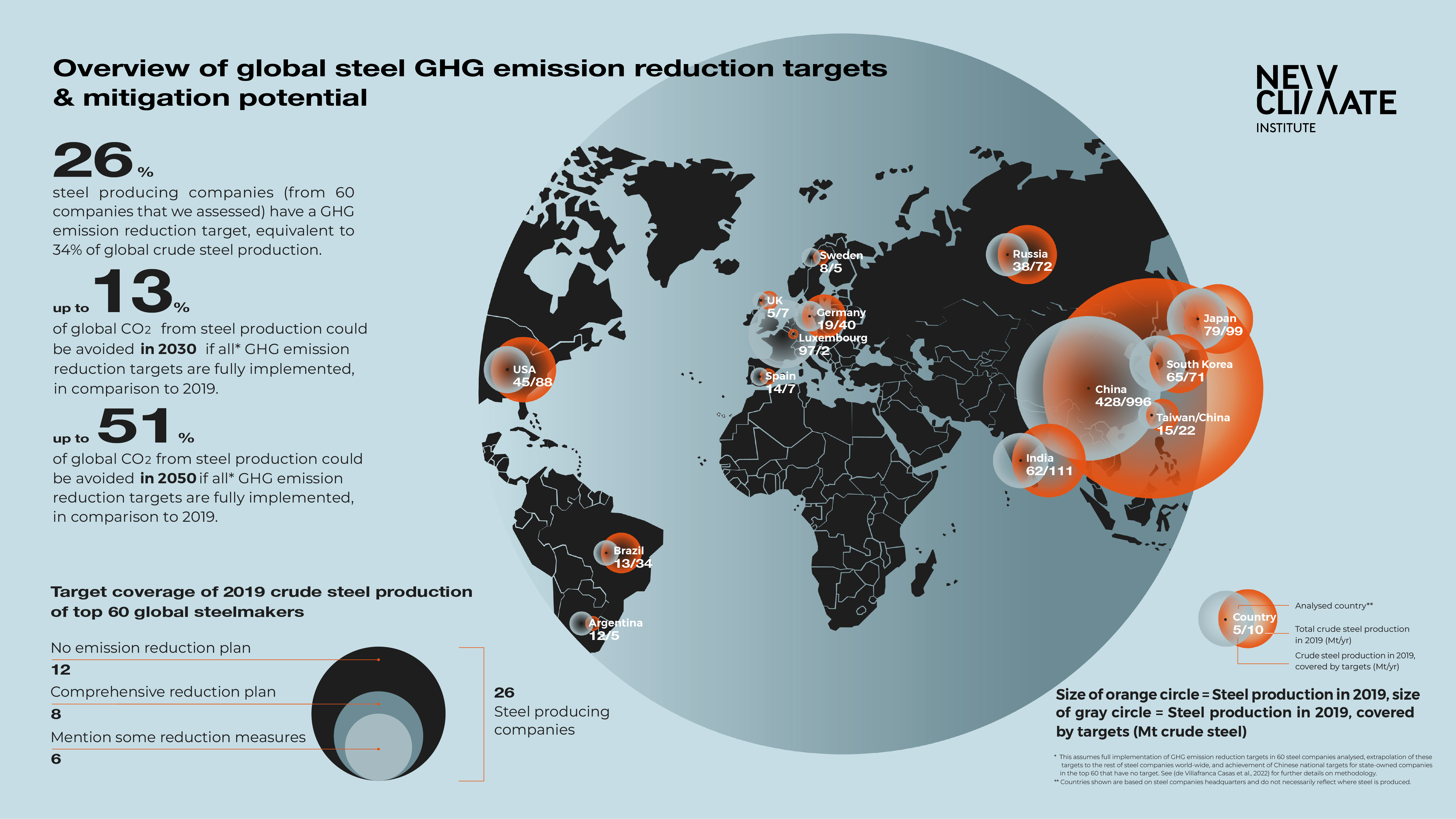

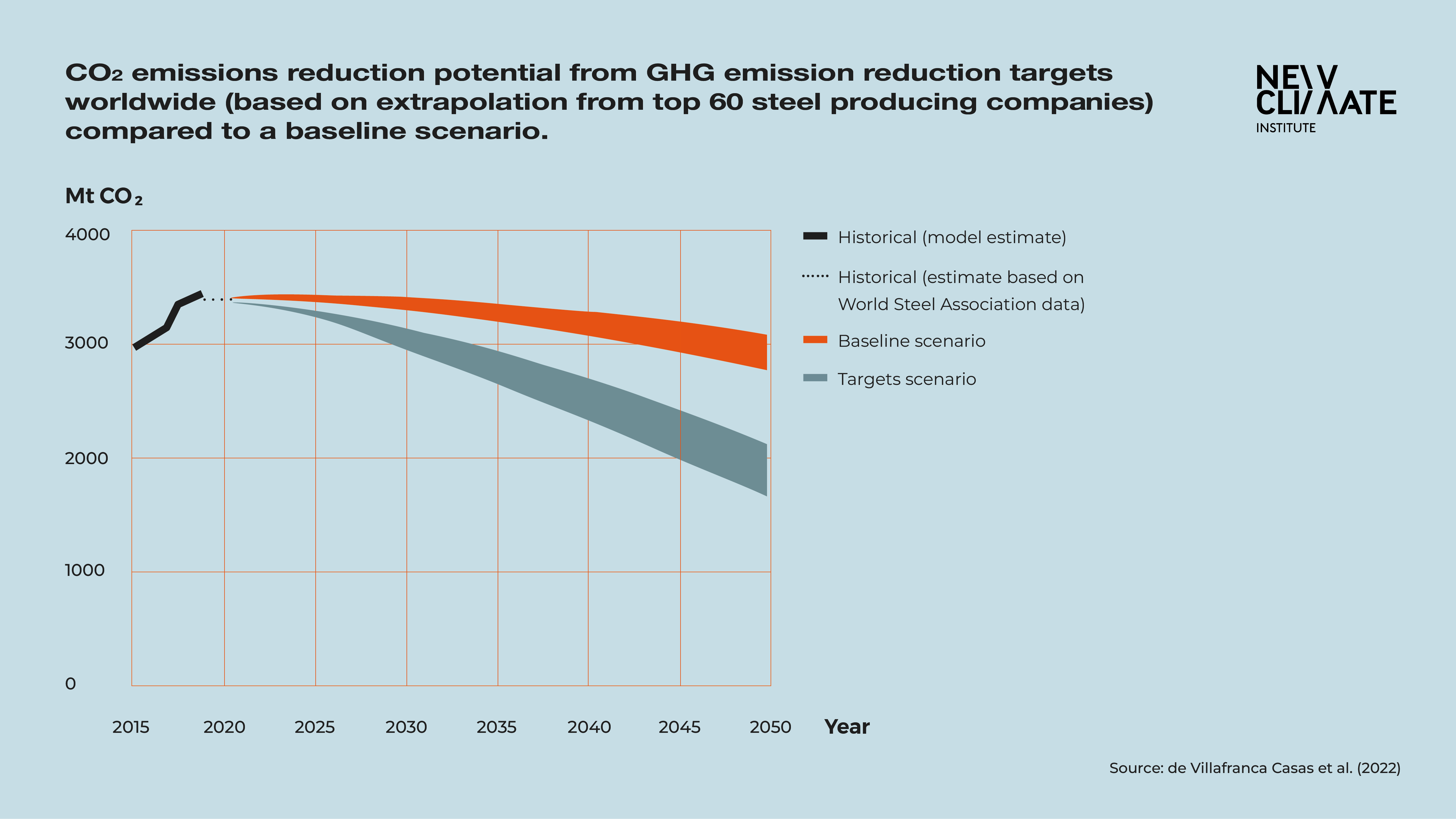

The global steel sector is making progress towards reducing its CO2 emissions but is not yet on track to halve CO2 emissions by 2030 or fully decarbonise by 2050, which supports other studies. We estimate that the global steel sector could potentially reduce CO2 emissions between 7-10% in 2030 and 30-39% in 2050, when compared to the baseline scenario, through full implementation of existing GHG reduction targets in steel producing companies. This is equivalent to a reduction from 2019 levels between 6-12% in 2030 and 36-50% in 2050.

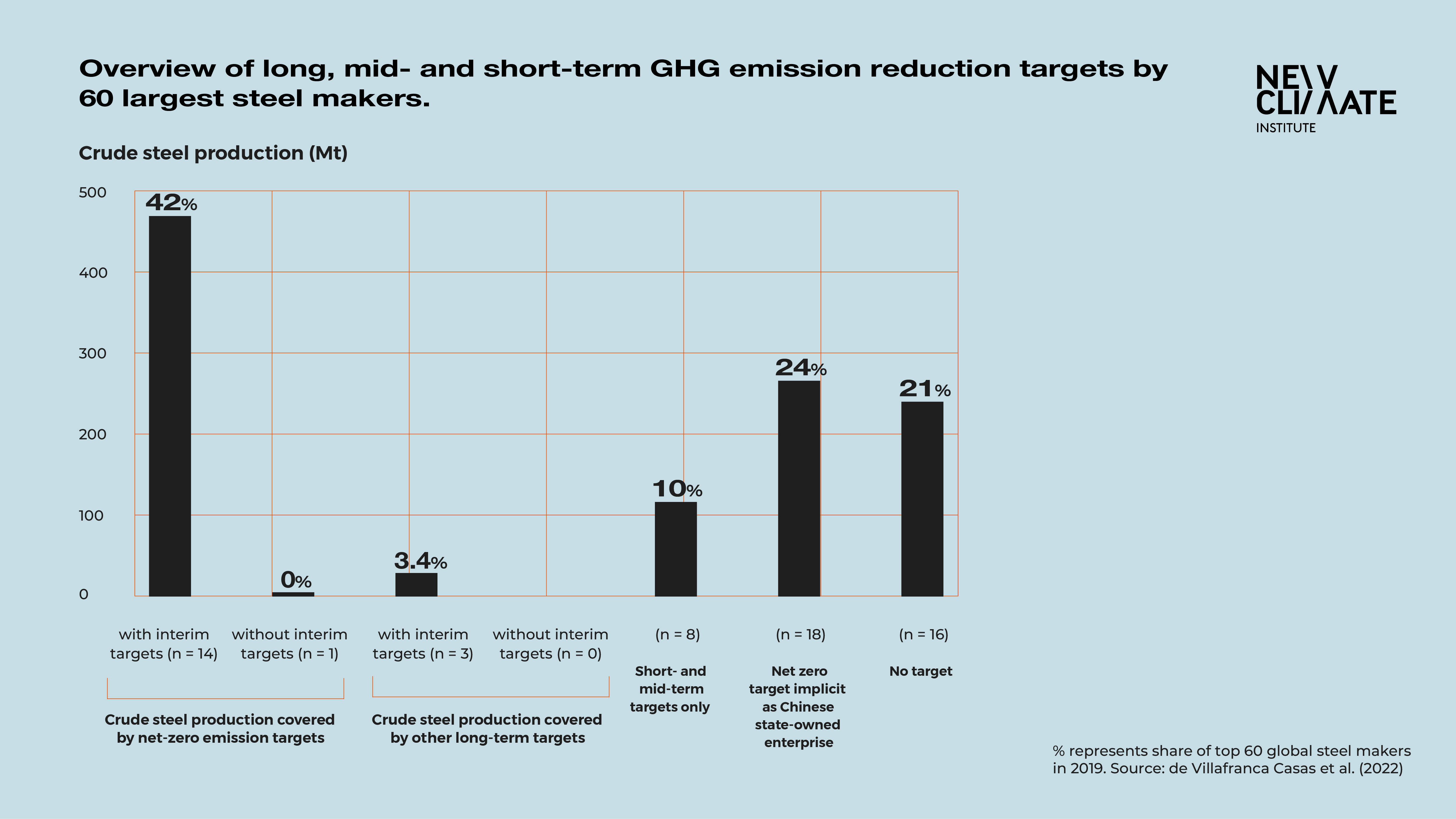

Our analysis of GHG reduction targets of the top 60 steel producers – collectively responsible for over 60% of global steel production and 65% or global CO2 emissions from steel production – shows that 26 of them had one or more targets.

From the 26 companies with one or more GHG emission reduction targets, we found that only 8 provide details on the measures and timeline to achieve them. Six companies provide limited information, while 12 do not provide any information on how they intend to achieve their targets. Not providing details about how companies plan to achieve net-zero emission and other types of GHG emission reduction targets leads to a lack of transparency and sets the global steel sector further away from a 1.5°C trajectory.

We estimate that the global steel sector could potentially reduce the emission intensity of steel production between 18-23% in 2030 and between 54-63% in 2050 from 2019 levels if all GHG reduction targets are implemented. In contrast, 1.5°C compatible benchmarks from literature concur that the emission intensity from steelmaking needs to gradually decline by more than 90% and up to 100% from 2019 levels by 2050. To achieve this, we have identified three key supply-side priorities for the global steel sector: (1) Cease new investments in blast furnaces unless built with technologies suitable for deep emission reductions, (2) Innovate and commercialise deep reduction technologies for primary steel production in a timely manner, and (3) Enhance the recycling of scrap steel.

- Cease new investments in blast furnaces unless built with technologies suitable for deep emission reductions.

- There is a window of opportunity to invest in low-carbon technologies (with deep mitigation potential) and avoid technological lock-ins – as almost half (45%) of the current BF-BOF stock is nearing its end of life.

- Innovate and commercialise deep reduction technologies for primary steel production in a timely manner.

- There is an increasing number of low-carbon steel plant projects over the last years, indicating the start of a potential exponential trend. Over half of these projects are still in the pilot or demonstration phase, and crucial steps are being taken towards large-scale deployment and commercialisation in the years to come.

- Enhance the recycling of scrap steel.

- Secondary steel production will play a key role in achieving the required emission reductions in a Paris compatible scenario, but the supply of scrap steel is currently one of the main barriers.

When analysing publicly available emission reduction plans of companies, we found that barely any steelmaker mentions the required transformation in the global steel sector. Some steelmakers highlight how challenging this will be for the company, but none acknowledge the challenge for the global steel sector.