This article, published in Energy and Climate Change journal, systematically assesses the status, robustness, and potential impact of greenhouse gas (GHG) emission reduction targets set by the 60 largest steel-producing companies worldwide as of mid-2022. Company-level data on GHG reduction targets and measures were collected from publicly available documents. The assessment covers the 60 largest steel companies by volume, accounting for more than 60 % of global steel production. Data on company-level greenhouse gas emission reduction targets and emission reduction measures were collected from publicly available documents.

Main Results

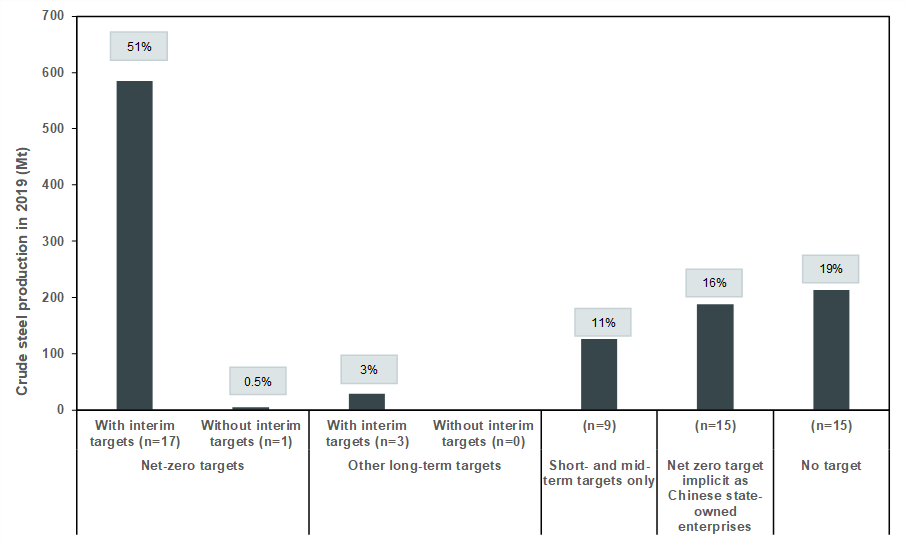

We found that only 30 companies have set GHG emission reduction targets of varying timeframes between 2025 and 2060. Even excluding the 15 Chinese state-owned companies aligned with the national 2060 net zero target, 15 companies had no emission reduction targets. Among them, 21 companies had long-term targets (2040 or beyond), 18 of which aimed for net zero emissions; all but one also had interim targets.

Fig. 1. Overview of GHG emission reduction targets set by the 60 largest steel companies. The percentage figures represent the shares in the total crude steel production of the 60 largest companies in 2019.

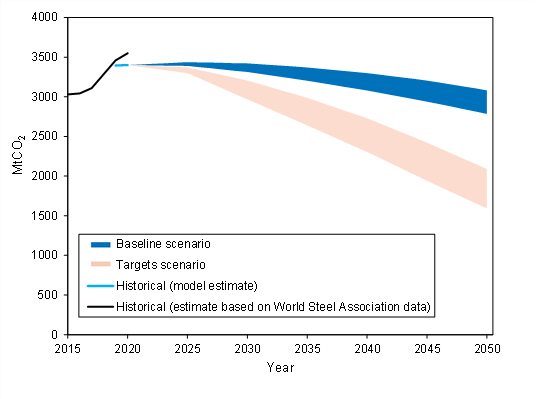

If all identified climate targets are met, annual CO2 emissions for the 60 companies could decrease by up to 12% by 2030 and up to 39 % by 2050 in comparison to a baseline scenario. Assuming a gradual increase in global crude steel demand from 1.9 Gt in 2019 to 2.5 Gt in 2050 and assuming similar trends for the rest of the global iron and steel sector as observed for the 60 companies, we estimate that the current ambition of the global iron and steel sector on emission reductions would lead to a reduction of 38 % to 53 % by 2050 from 2019 levels (3.4 GtCO2 to 1.6–2.1 GtCO2), or compared to a 32 % to 43 % reduction in a baseline scenario in 2050.

Fig. 4. CO2 emissions trajectories from global steel production and potential CO2 emissions mitigation from achieving all GHG reduction targets in the 60 largest steel producers and the rest of the world.

Steel companies are also lagging in setting clear emission reduction plans to achieve their targets. Out of the 30 steel producers with targets, 14 failed to provide a concrete plan. Notably, the most popular measures among the 16 companies that had at least one measure to achieve their emissions reduction targets were hydrogen-based Direct Reduced Iron (DRI) (n = 14), enhanced use of renewable electricity (n = 13), and Carbon Capture Utilisation and Storage (CCU/S) for blast furnaces (n = 9). While it is encouraging to see progress in decarbonisation efforts, our findings suggest that there is still a long way ahead, and we need accelerated, substantial action.

This study provides a current snapshot of the emission reduction target-setting landscape in the iron and steel sector. Both the climate actions by individual companies and the discussions around corporate climate action integrity are evolving fast, possibly indicating new developments amongst the 60 major steel companies since the literature cut-off date.

Policy recommendations

- National governments should pressure steel companies to set emission reduction targets consistent with their long-term net-zero goals or global net-zero CO2 emissions by 2050. They should also support the iron and steel sector, fostering demand for low-carbon steel through public procurement to ensure a smooth transition to deep decarbonization.

- Companies should set both long-term and interim deep decarbonisation targets, along with detailed transition plans outlining technological options and deployment roadmaps. Acknowledging potential residual emissions, companies should transparently communicate their plans for neutralizing these emissions.

- International cooperation and public-private partnerships are also crucial for Research, Development, and Deployment (RD&D) of low-carbon steel while ensuring fair global market competition.