Development banks not only provide finance directly to specific projects, they also channel funds to financial intermediaries, for example local banks, in developing and emerging economies. Development banks, notably including the major multilateral development banks and members of the International Development Finance Club (IDFC) have committed to align themselves with the Paris Agreement. While they have made (some) progress with establishing Paris lending criteria for their direct lending activities – clear rules and guidance for how to align “intermediated lending” with the Paris Agreement remains a gap.

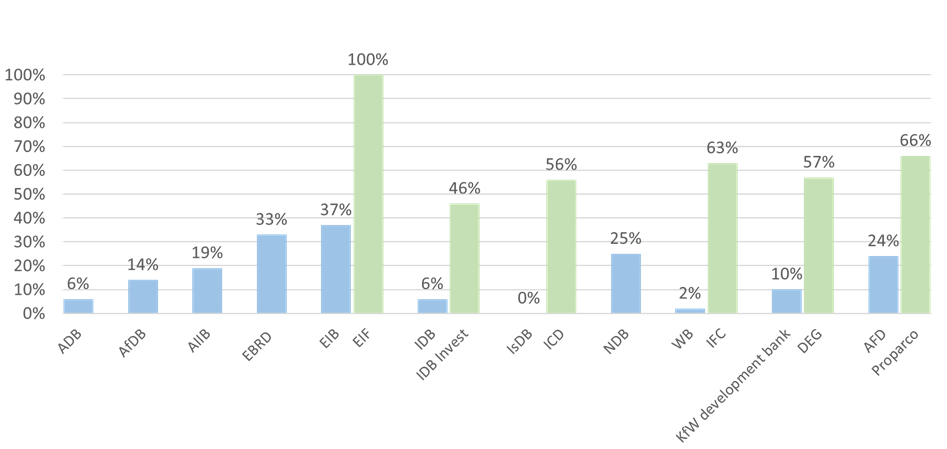

Even before the COVID-19 pandemic, “intermediated” lending represented a significant share of total commitments for many multilateral and bilateral development banks (see Figure 1). Though final data is still outstanding, the role of intermediated finance grew as part of the response to stabilise markets in the wake of the economic fallout from COVID-19. For example, the International Finance Corporation (IFC) committed 6 of its 8 billion USD fast track COVID-19 support through financial inter

mediaries (FIs) (IFC 2020a). Experts expect intermediated lending to continue to grow.

Figure 1: DFI Investments through FIs as a share of total DFI investments (2019). Notes: 1; Sources: 2

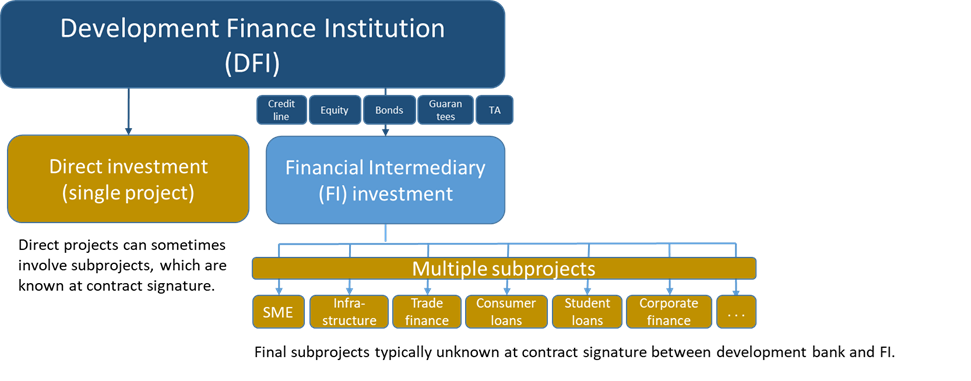

Aligning intermediated finance with the Paris Agreement is not straight forward. Local financial institutions use money provided to them to fund a variety of subprojects, the details of which are typically not yet known to the original provider of the funds at the time of their investment decision (see figure 2). This generally passes responsibility for the due diligence process and approval of the final subproject to the intermediary which may not have established the same lending criteria – or Paris alignment aspirations - as the development bank providing the original finance. This lending practice is a challenge that development banks urgently need to address as finance they provide may end up supporting non-Paris aligned investment activities.

Figure 2

In order to “build back better” and in keeping with development banks commitments to align their financial flows with the goals of the Paris Agreement3, it is essential that the end use of intermediated finance also supports the achievement of overall climate objectives. So far, the focus of development banks has primarily been on developing and implementing Paris aligned investment criteria for direct lending.

Some banks have started working on the issue. MDBs intend to present a joint framework for Paris alignment of intermediated finance at COP26 and the French bilateral development bank Agence Française de Développement (AFD) has established an internal working group to develop respective criteria.

Germanwatch, NewClimate Institute, and World Resources Institute, have written a working paper providing input to the discussion on how to align intermediated finance. Here are the top three things that we suggest that development banks do when considering supporting a financial intermediary counterparty.

1. Develop and disclose clear Paris alignment strategies for intermediated lending with commitments for transparency and thorough oversight

1.1. A solid FI policy framework or strategy document is a key prerequisite. This should include a commitment to align intermediated finance with the Paris Agreement and set a clear timeline for when all FI investments will be Paris aligned. In many cases, this will require significant new capacity, much more transparency, and more resources to oversee intermediated lending.

1.2. Development banks will need to develop the necessary capacity and organizational processes to accompany, monitor and disclose the Paris alignment assessments of final subprojects. This will mean moving away from current practice, where most development banks dedicate significantly fewer resources to FI transactions and their subprojects than to direct lending.

1.3. It is vital to assess and disclose whether a financial intermediary meets institutional and subproject level Paris alignment standards (see also 2.). This would include information on where the intermediary stands in terms of capacity and organizational processes, as well as agreed steps and resources to progress. Development banks could also opt to fill capacity gaps with their own processes and help close them over time. In this case they should disclose for which time period the intermediary would refer projects to the development bank for Paris alignment assessments.

1.4. Paris alignment standards and requirements are meaningful to the degree that they are legally binding. Therefore, they should be included in the legal contracts with FIs.

1.5. Transparency is a prerequisite for accountability of development banks and their intermediaries with regard to the implementation of standards. Development banks should thus monitor whether subprojects meet all Paris alignment criteria and disclose disaggregate subproject information. This includes addressing a crucial shortcoming that today, development banks have significantly less information about final subprojects supported by their FI clients than they have for their direct lending projects.

2. Establish robust and ambitious Paris alignment requirements for financial intermediary counterparties

For development bank investments through FIs to be considered Paris aligned, FIs should meet alignment requirements in four areas: mitigation (subproject level), adaptation (subproject level), climate governance (institutional level) and transparency (institutional level).

For climate mitigation, exclusion lists, emissions standards, and transition risk assessments can help avoid high emitting investments. To maximise resiliency, intermediaries should conduct qualitative and quantitative risk assessments and integrate likely climate impact risk mitigation into project design. At the institutional level intermediaries should commit to Paris alignment and move quickly to implement this commitment by building the necessary capacity and processes. Finally, transparency and disclosure are important – and intermediaries should report on the sector breakdown of overall portfolios, details on subprojects financed using development bank funds and Paris alignment assessments of subprojects (see forthcoming working paper for more details).

A phased approach with increasing stringency over time can ensure practicability also for intermediaries with limited capacity. Such an approach would define immediate requirements as well as additional steps that intermediaries should take over time, based on the capacity of the intermediary, for complete compliance. This complete process should not exceed five years.

3. Tailor the financial instrument to the climate risk of the financial intermediary counterparty

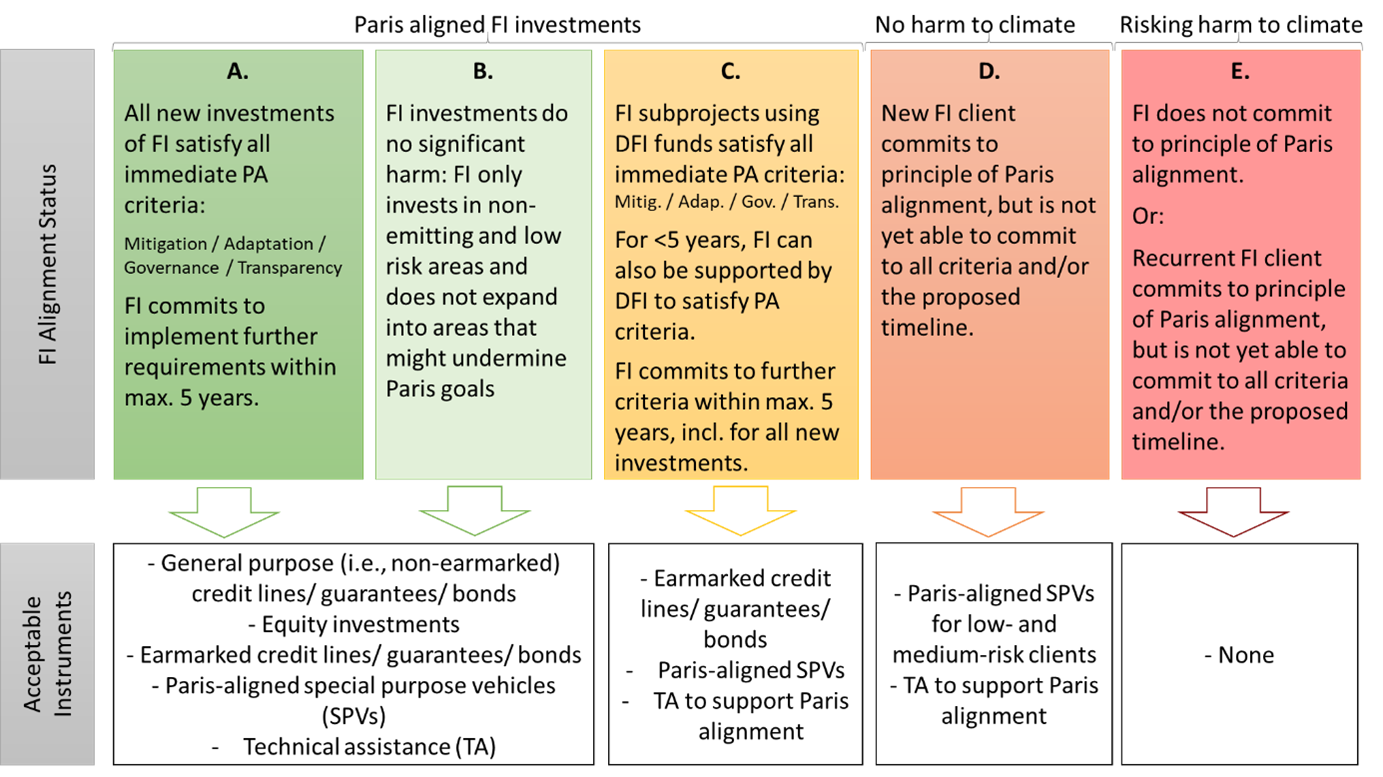

Ultimately, it is the development bank’s responsibility to ensure that its intermediated finance is Paris aligned. To live up to this responsibility, development banks should take a deliberate approach to selecting the investment instruments they use in FI projects, as different instruments pose varying levels of risk. We lay out options for development banks to invest through financial intermediaries in a Paris aligned way (Figure 3).

Figure 3

Paris aligned financial intermediary investments: General purpose lending and equity investments pose the greatest risk of supporting misaligned investments. Therefore, development banks should only provide this kind of support to counter parties that align all their new investments – financed from development bank funds or not - with regard to mitigation, adaptation, governance, and transparency (Category A in Figure 3) or whose operations have negligible climate impacts and risk, such as small consumer loans (Category B).

In practice, most FIs are engaged in a variety of different lending activities and often do not yet have criteria in place to screen new investments for Paris Alignment. If such an FI is generally willing to make a commitment to Paris alignment and start to implement it, DFIs could consider an engagement option. In such a case, the FI should be willing to comply with DFI Paris alignment criteria for earmarked development bank funds, commit to minimum criteria for their new investments (including funds not from the DFI), and make regular progress towards complete alignment with a clear timeline that should not exceed five years. In working with these kinds of FI, DFIs will likely need to closely monitor progress, and potentially take on an important role in conducting assessments and building the capacity of FIs through technical assistance (Category C).

No harm to climate goals: For intermediaries that commit to the principle of Paris alignment4, but who are not (yet) able to commit to implementing the criteria within the required timeline, a few options for engagement remain. These must ensure that no harm is done to climate goals and that the FI makes constant progress in aligning themselves according to an agreed timeline. For example, development banks could provide targeted technical support to new FI clients with the aim to support them in identifying climate risks or establishing a Paris alignment plan. Development banks could under certain circumstances also use a Paris-aligned special purpose vehicle (Category D).

Risking harm to climate goals: Intermediaries, existing or new, that that are not willing to commit to Paris alignment at all, should not receive any further support (Category E).

Summary of Recommendations:

In summary, development banks can do three things to align their financing through financial intermediaries with the goals of the Paris Agreement.

- Realize institutional changes within the development bank to support and supervise financial intermediaries more thoroughly

- Establish institutional and subproject level Paris alignment requirements for financial intermediary clients, use a phased approach and support implementation

- Select the investment instrument depending on the Paris Alignment status of the Financial Intermediary

Taking these elements into account, it is of utmost importance that the MDBs follow through with their announcement to present their Paris alignment approach at COP26, and for other financial institutions purporting to align themselves also follow suit. Both MDB and other DFI Paris alignment commitments need to move quickly to expand their strategies and investment frameworks to include intermediated finance and set clear timetables to implement them in decision making.

1 Numbers are not fully comparable between development banks, as definitions and reporting standards on FI investments are not harmonized among development banks. The following definitions were used in line with available information in databases and reports: For ADB data on ‘finance sector’ (excluding PBLs), for AfDB and IsDB data on ‘finance’, for AIIB data on ‘financial institutions’, for EBRD data on ‘financial institutions and other financial sectors’, for EIB data on ‘credit lines, guarantees and equity/quasi-equity’, for IDB data on ‘financial markets’ (excluding PBLs), for IDB Invest, WB, IFC, NDB, AFD and Proparco data on ‘FI E&S category’, for ICD data on ‘line of financing and institutional equity’, for KfW development bank data on ‘banking and financial services’ and for DEG data on ‘financial institutions and funds’.

Numbers for IsDB refer to IsDB Ordinary Capital Resources.

Numbers for EIB equity and quasi-equity may include financing channeled via national or local authorities.

2 Sources:

ADB. 2020. “2019 Universal Registration Document.” https://www.afd.fr/en/ressources/2019-universal-registration-document.

ADB. n.d.“ADB Project Database.” https://www.adb.org/projects;

AfDB. 2020. “Annual Report 2019. African Development Bank Group.” https://www.afdb.org/en/documents/annual-report-2019.

AIIB. 2020. “Review Draft - Environomental and Social Framework.” https://www.aiib.org/en/policies-strategies/_download/environment-framework/AIIB-Review-Draft-Environmental-and-Social-Framework_Sept-7-2020.pdf.

DEG. 2020. “Annual Report 2019. Financial Statements an Management Report.” https://www.deginvest.de/DEG-Documents-in-English/Download-Center/DEG_Annual_Report_2019_EN.pdf.

EBRD. 2020. “Annual Review 2019.” https://www.ebrd.com/news/publications/annual-report/ebrd-annual-review-2019.html.

EIB. 2020a. “Data on Gurantees and Equity/Quasi-Equity in 2019 Provided by EIB Civil Society Unit on Request.”

EIB. 2020b. “EIB Website: Investments in Infrastructure and Environmental Funds.” https://www.eib.org/en/products/equity/infra-environment-funds/index.htm.

EIB. n.d. “EIB Project Database.” https://www.eib.org/en/projects/loans/index.htm?q=&sortColumn=loanParts.loanPartStatus.statusDate&sortDir=desc&pageNumber=0&itemPerPage=25&pageable=true&language=EN&defaultLanguage=EN&loanPartYearFrom=1959&loanPartYearTo=2021&orCountries.region=true&orCountries=true&orSectors=true.

ICD. 2020. “Annual Report 2019. 20 Years Is Our Heritage. But the Future Is Our Legacy.” https://icd-ps.org/uploads/files/ICD%20Annual%20Report%202019%20EN1591870437_6879.pdf.

IDB. n.d. “Project Database.” https://www.iadb.org/en/projects-search?

IDB Invest. 2020. “Let’s Use Financial Engineering for Good, with a New Structured Product.” https://idbinvest.org/en/blog/financial-institutions/lets-use-financial-engineering-good-new-structured-product.

IFC. 2020a. “Annual Report 2019. Investing for Impact.” https://www.ifc.org/wps/wcm/connect/4ffd985d-c160-4b5b-8fbe-3ad2d642bbad/IFC-AR19-Full-Report.pdf?MOD=AJPERES&CVID=mV2uYFU.

IsDB. 2020. “Annual Report 2019. Shaping New Frontiers for Sustainable Development.” https://www.isdb.org/sites/default/files/media/documents/2020-06/1%20Annual%20Report%202019%20English%20Cleared.pdf.

KfW. n.d. “Transparency Portal on Development Finance.” https://www.kfw.de/microsites/Microsite/transparenz.kfw.de/#/start.

NDB. n.d. “Project Database.” https://www.ndb.int/projects/list-of-all-projects/approved-projects/.

World Bank. n.d. “Project Database.” https://projects.worldbank.org/en/projects-operations/projects-list.

3 Multilateral Development Banks and Members of the International Development Finance Club (IDFC) have committed to align all their financial flows with the Paris Agreement in 2017: https://www.afdb.org/fr/news-and-events/one-planet-summit-joint-idfc-mdb-statement-together-major-development-finance-institutions-align-financial-flows-with-the-paris-agreement-17685

At COP24 in 2018, nine multilateral development banks committed to develop and disclose an approach to assess Paris alignment: https://www.eib.org/attachments/press/20181203-joint-declaration-mdbs-alignment-approach-to-paris-agreement_cop24.pdf

4 As for example 347 public development banks and 38 global private banks have already done: https://www.unepfi.org/banking/bankingprinciples/collective-commitment/; https://financeincommon.org/sites/default/files/2021-01/FiCS%20-%20Joint%20declaration%20of%20all%20Public%20Development%20Banks_0.pdf