Slow improvement in companies’ climate targets threatened by potential new offsetting loophole

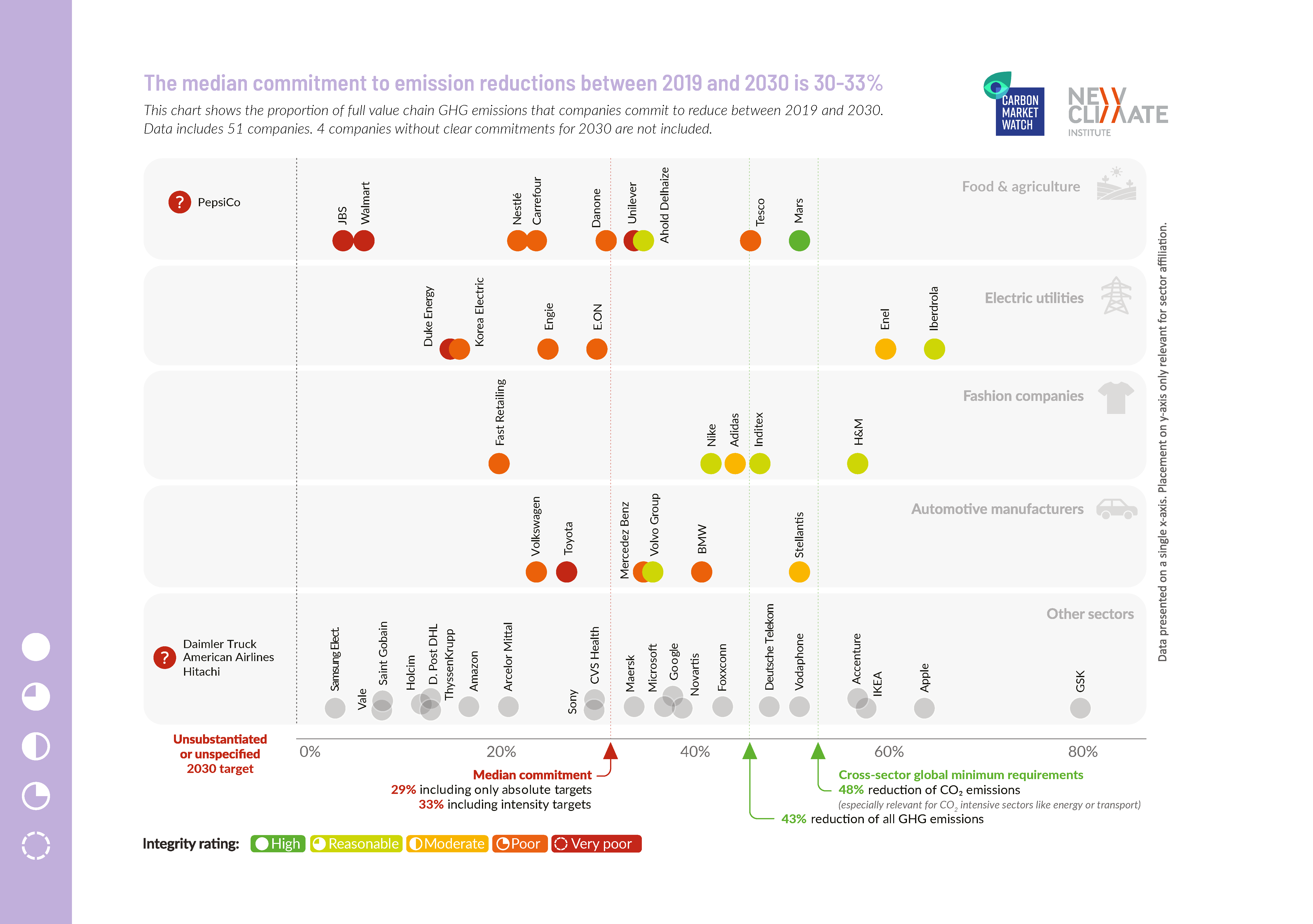

Berlin, 09 April 2024 – Despite increased ambition in their climate target-setting, 51 of the world’s largest companies commit to reducing their emissions by only 30% on average by 2030, falling short of the 43% reduction required to limit global warming to 1.5°C, according to a report released today by NewClimate Institute in collaboration with Carbon Market Watch.

While the slight improvement in the companies’ targets is a positive step, the report warns against taking these targets at face value, as many companies still rely on loopholes and false solutions to exaggerate the ambition of their plans. Proposed rules on the use of carbon credits also threaten to nullify the already insufficient commitments, according to the analysis.

In its third iteration, the 2024 Corporate Climate Responsibility Monitor (CCRM) evaluated the transparency and integrity of climate pledges of 51 major companies across different sectors and geographies. Nineteen made improvements to their climate targets in the past two years. Notably, companies like Iberdrola, Enel, Danone, Mars and Volvo Group have updated their plans to align with more ambitious climate goals. However, most companies still present 2030 and net-zero targets that are either ambiguous or only commit to limited emission reductions, according to the report.

Some companies’ targets may appear similar on the surface, but the integrity of their commitments hinges on specific details – whether companies leave out significant parts of their emissions or plan to offset them with carbon credits. Taking such details into account, the CCRM analysis found that companies like Walmart, Duke Energy, KEPCO, and Fast Retailing commit to reducing only 5%-20% of their full greenhouse gas emission footprint by 2030. In contrast, others from the same sectors like Mars, H&M Group, Enel, and Iberdrola commit to reducing 50%-64% of their emissions.

Frederic Hans from NewClimate Institute said: “Four years into the critical decade for action on climate change, some companies have understood the need to set 2030 targets that are aligned with the latest climate science and substantiated by credible measures to achieve them. However, there still is a concerning lack of commitment and urgency from too many companies to undertake credible climate action.”

The report comes amid an ongoing debate over a proposal to permit the use of carbon credits towards emission reduction targets. The proposed “beta Scope 3 Flexibility Claim” of the Voluntary Carbon Markets Integrity Initiative (VCMI) could lead to companies backsliding, in many cases nullifying already insufficient targets. This would contradict recommendations from a UN High-Level Expert Group for corporate climate targets, according to the authors.

The report also sheds light on the limitations of voluntary initiatives in validating corporate climate pledges. Despite the inadequacy of their targets, most companies assessed in the CCRM have been validated by the Science Based Targets initiative (SBTi) – the largest and most influential validator of corporate climate targets – as having 1.5°C-aligned targets for 2030. A comparison of SBTi validations with the assessments of other independent organisations and initiatives points to multiple areas for improvement of current validation practices.

“The polarisation and uncertainty of the current political dialogue on climate regulation underlines the need for voluntary initiatives to be strengthened to incentivise and reward the gold standard of corporate climate action”, said Thomas Day from NewClimate Institute. “Rather than allowing further flexibility that would weaken already insufficient targets, a refinement of the standards to focus more specifically on the most critical emission sources for each sector could help companies to better navigate the challenges of their transition.”

Another concerning trend highlighted in the report is companies’ reliance on false solutions to reduce emissions, which diverts attention from the necessary level of action implied in their net-zero or carbon neutrality pledges. Only a few companies, such as Danone, Iberdrola and Volvo Group, commit to implementing the measures required towards the deep decarbonisation of their sectors. Examples of false solutions include carbon capture and storage in the power sector, excessive reliance on temporary carbon dioxide sequestration in the agriculture sector and the use of unsustainable bioenergy instead of renewable electricity in the fashion sector, according to the report.

Silke Mooldijk from NewClimate Institute said “On top of setting insufficient climate targets, many of these targets are not even being substantiated by meaningful actions to reduce emissions. This highlights a need for clearer guidelines on sector-specific transition plans that promote emerging good practices instead of the false solutions that we too often see.”

Overall, none of the companies covered by the report were assessed to have climate strategies of “high” integrity. Enel and Iberdrola were assessed to have “reasonable” integrity because of their fossil fuel phase-out commitments to substantiate their ambitious targets. KEPCO and Toyota were assessed to have “very poor” integrity due to the inadequacy of their targets and measures, alongside a lack of transparency in disclosing their greenhouse gas emissions (see Table 1).

In light of these findings, the report emphasises the need for shifting corporate climate strategies away from voluntary standards and toward formal accountability.

Benja Faecks from Carbon Market Watch said: "Effective climate regulation will be essential to hold companies formally accountable to enforceable standards for climate action. Civil society, investors, and governments depend on transparent and credible rules to distinguish well-substantiated transition plans from those that remain inadequate and prone to greenwashing."

Catherine McKenna, Chair of the UN Secretary-General’s High-level Expert Group on Net-Zero Commitments, said: "The improvement in the climate commitments of some of the world’s corporate leaders is positive, making the pathway to net zero stand out even more clearly.

But, we need 2024 to be the year where incrementalism is cast off. The policy is unequivocal: three quarters of national-level net zero targets are already enshrined in law or policy. The economics is exponential: $1.7 trillion was invested in clean energy in 2023, 65% more than into fossil fuels.

The defining race of these upcoming decades - shaping the net zero economy - will not be won through baby steps, but through bold and credible leadership."