Much of the world currently finds itself in the midst of an energy crisis tied to jumps in the price of gas. Expanded investments in gas extraction, infrastructure, and gas-fired electricity generation plants sound like they could be solutions to the global gas crunch. New research from NewClimate Institute finds that continued reliance on gas is more likely to be an expensive distraction aggravating the situation – while undermining energy security and climate mitigation efforts. In the vast majority of cases, renewables and electrification represent the best solution.

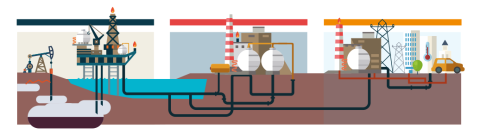

Around the world, consumers of natural gas find themselves in the midst of an energy crisis. Gas, traded as part of an increasingly global market due to expanded LNG infrastructure, has surged to record price heights – 280% in Europe and 100% in the US since the start of the year. This comes ahead of a potentially cold winter in the northern hemisphere where demand for heat peaks. Such a price spike puts enormous pressure on the region and translates into steeper energy bills for industrial and residential consumers. Large companies have warned that rising gas prices could seriously jeopardize economic recovery in the wake of the COVID-19 crisis, as manufacturing costs surge and production in Europe and Asia is curtailed for energy-intensive processes. The US expects household spending on gas to jump 30% this winter. Policy makers are searching for ways out of the crisis but are also faced with geopolitical manoeuvring and calls for more climate ambition.

Energy security: More gas means more uncertainty

Policy makers and financial institutions should be weary of promoting gas related investments as a solution to this crisis – in most cases it offers a false or only a short-term remedy. In Europe, for example, which does not have significant domestic gas reserves and is dependent on imports, further investment in import infrastructure would only increase Europe’s exposure to volatile global gas prices – especially if the Asian market continues to buy at any price. In Germany, some are calling for a rapid approval of Nord Stream 2 to increase supplies. This simultaneously risks encouraging and locking in more gas investments downstream, which would in the long run increase the dependency on imports. The only way of reducing dependence and increasing energy security is by minimising the role that gas plays through energy efficiency measures, electrification of end uses, and a rapid build-out of renewable energy.

Costs: More gas means higher energy bills

The attractiveness of renewable alternatives at current high gas prices goes without saying – just ask anyone who has their own PV panels, an electric car, and electrified appliances such as electric boilers and heat pumps. Even when the current crisis passes, the cost advantage of renewables (or, vice versa, the economic risk associated with fossil gas) will persist and grow: While renewable energy technology costs keep on falling, gas extraction and shipment costs set a price floor below which production is not profitable. In most cases, electricity generated from renewables is already cheaper than gas-fired power; in nearly half the world it is cheaper to generate electricity from new renewable energy plants than running existing fossil fuel plants.

Both the technological and economic rationale for new investments in gas are weak. Moreover, from a climate perspective, considering gas’ large climate impact, wherever gas investments can be avoided, they must be avoided. In the EU, current debates around the climate friendliness of gas are high on the agenda considering not only the current energy crisis, but also the EU’s implementation of the Sustainable Finance Action Plan. A political decision to go against the EU’s Technical Expert’s Group recommendations and include gas in the EU Taxonomy of sustainable activities could severely undermine the taxonomy’s credibility. We have the technology to meet growing power demand with fully decarbonized energy systems. Accelerating the decarbonisation of the electricity mix with ramped up renewable energy generation, expanded storage, and smart grids and demand response is essential to effectively responding to the climate, COVID-19, and energy crises.

Recent research from NewClimate Institute provides a detailed survey of climate, transition, and lock-in risks of gas investments and the variety of readily deployable, technologically mature, and cost-competitive renewable energy-based alternatives. Written primarily for development finance institutions with commitments to “Paris alignment” it is relevant for government policy makers in both gas exporting and importing countries, private investors, shipping companies, and anyone considering buying or remodelling a house.