Financial institutions' current investments in gas reflect an underestimation of climate risks, including the extent to which gas value chain investments pose a threat to achieving 1.5°C. This report surveys these risks, outlining the need for much tighter restrictions on lending for all parts of the gas value chain.

Key Findings:

Rapid and far-reaching decarbonisation of the energy system is essential to achieving the objectives of the Paris Agreement. Of particular importance is the “critical decade” between 2020 and 2030, where emissions need to fall 7.6% every year. Committed emissions from planned and operational energy infrastructure are already likely to exceed the remaining carbon budget for a pathway consistent with a 50-66% probability of meeting the 1.5 degrees Celsius (°C) temperature goal.

In 2018, development finance institutions (DFIs) – both multilateral development banks (MDBs) and members of the International Development Finance Club (IDFC) – pledged to align their activities with the goals of the Paris Agreement. A growing number of private sector asset owners and asset managers have also begun to set net-zero targets or make other kinds of climate and environmental, social, and governance (ESG) commitments. In line with these commitments, both DFIs and the private sector have broadly moved away from directly financing coal, but they continue to provide significant finance for new gas projects and related infrastructure. A limited number of DFIs have started to adopt restrictions for gas finance, but most DFIs lack clear and effective strategies on phasing out fossil fuel support – including gas – in line with the Paris Agreement. DFI energy and climate policy updates provide an opportunity to shift DFIs’ current lending trends to keep up with accelerated global climate targets.

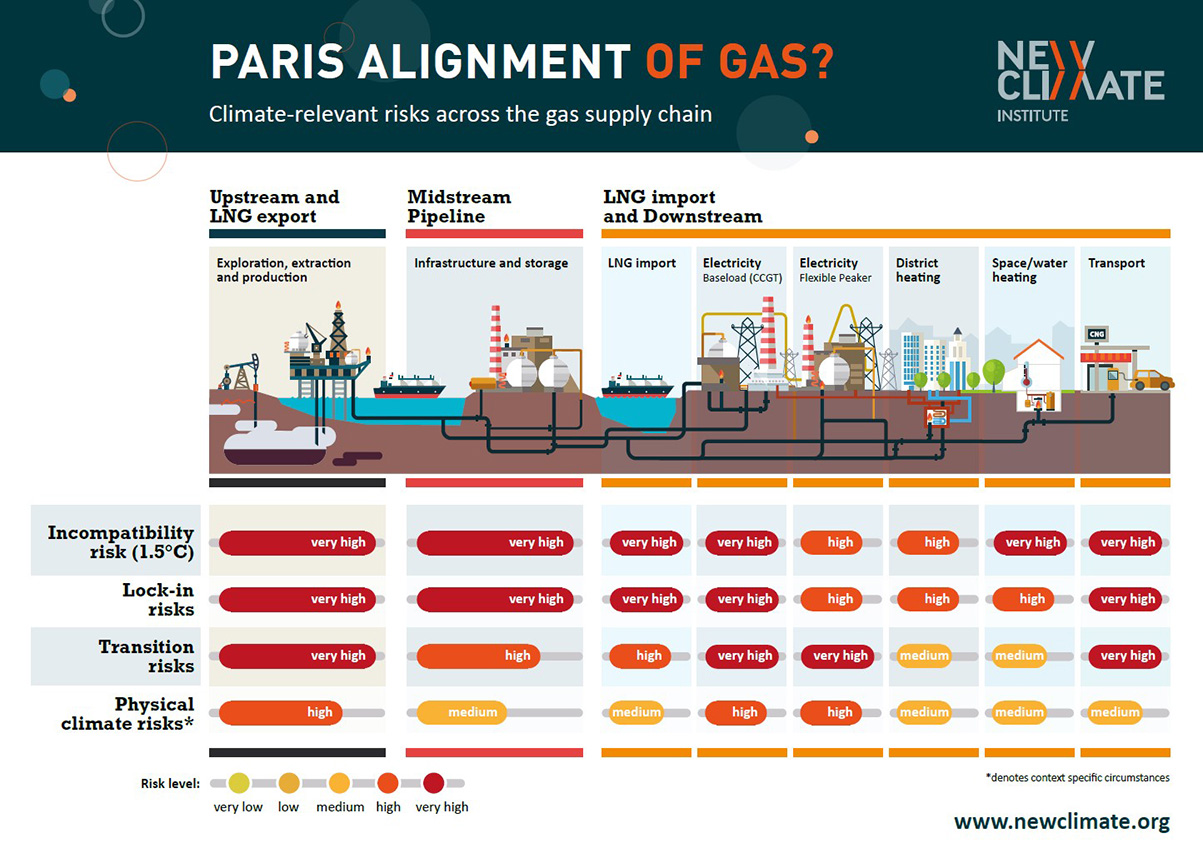

Considering its significant climate impact, gas should not be seen as a bridge or transition fuel. Lifecycle assessments of gas generally undermine rationales for the use of gas as a climate-friendly alternative. Swift technological progress and the falling costs of renewable energy-based alternatives, energy storage, and the electrification of end uses means that investments in gas are not only increasingly incompatible with overall climate targets – they are also associated with serious high-emission lock-in, transition, and physical climate risks. These developments, however, have different consequences for each part of the gas value chain, from upstream extraction, export, and midstream to the various end uses.

This report provides an overview of available benchmarks from various modelling exercises and reviews associated lock-in, transition, and resiliency risks of various investments. Based on these finding, we propose guidance to avoid, manage and minimize these risks and help steer finance flows towards consistency “with a pathway towards low greenhouse gas emissions and climate-resilient development”.