Multilateral development banks (MDBs) can play a critical role in limiting climate change and helping communities adapt to its impacts. Since 2011, they have provided nearly $200 billion in finance for climate change mitigation and adaptation (so-called “climate finance”). The World Bank Group’s recent announcement that it will increase its climate-related investments means this number is likely to grow. But while climate finance is important, it makes up less than a quarter of all finance provided by the MDBs. The rest goes to activities that may (or may not) undermine climate goals.

If we are going to have a fighting chance at meeting climate goals, MDBs must make sure not only that their climate finance investments support climate objectives, but also that no other MDB investments undercut them. The banks should transition from what we call a “climate finance paradigm”—based on defining, measuring, and meeting climate finance targets—to a “Paris alignment paradigm” which seeks alignment of entire portfolios with the Paris Agreement. On December 3, 2018, the MDBs pledged to develop a new approach aimed at facilitating this transition.

A report launched today at the climate negotiations in Katowice, Poland, outlines four key steps that the MDBs should take as they work towards operationalizing the Paris alignment paradigm. These include: aligning their investments with net-zero CO2 emissions, mainstreaming climate change resilience, supporting and enhancing country climate goals, and ensuring transparency on the Paris alignment of their activities.

1. Align investments with net-zero CO2 emissions

Countries have committed to limiting global temperature increase to 1.5°C or “well below” 2°C.[1] To reach this goal, global CO2 emissions must be net zero by around 2050.[2] This means, for example, that the electricity sector needs to stop emitting CO2 by that time and that we simultaneously have to remove CO2 from the atmosphere to balance sectors where emission reductions are more difficult (like the aviation sector).

Most MDBs have adopted a variety of tools and systems to calculate greenhouse gas emissions associated with their investments. Some have also promised to stop funding certain types of highly-emitting technologies, like coal-fired power plants. But none have committed to reducing emissions associated with their investments to align with the need to decarbonize by mid-century. There are various tools, including GHG emissions targets and exclusion of GHG-emitting investment (e.g. based on country-specific decarbonization pathways), that MDBs can use to help ensure that investments align with the global temperature goal.

2. Ensure full mainstreaming of climate resilience

Climate change is already here, and it will worsen over the next decades even with aggressive emissions reductions. All investments should be designed with this in mind. Projects should consider both long- and short-term climate risks under different climate scenarios. While project developers should work towards ambitious global temperature targets, they should prepare for scenarios of 3-4°C of warming by the end of this century.

Most MDBs have begun to screen their investments to flag projects that may be significantly impacted by climate change (or plan to start such screening soon). Most also have examples of projects that were designed with careful consideration of climate vulnerabilities. But MDBs still struggle to ensure that all investments reflect sound understanding of climate risks and vulnerabilities. This will require investing in localized climate-related data, staff and client capacity, and internal MDB incentives that encourage action to reduce vulnerability and enhance resilience.

3. Support the implementation and enhancement of national climate commitments

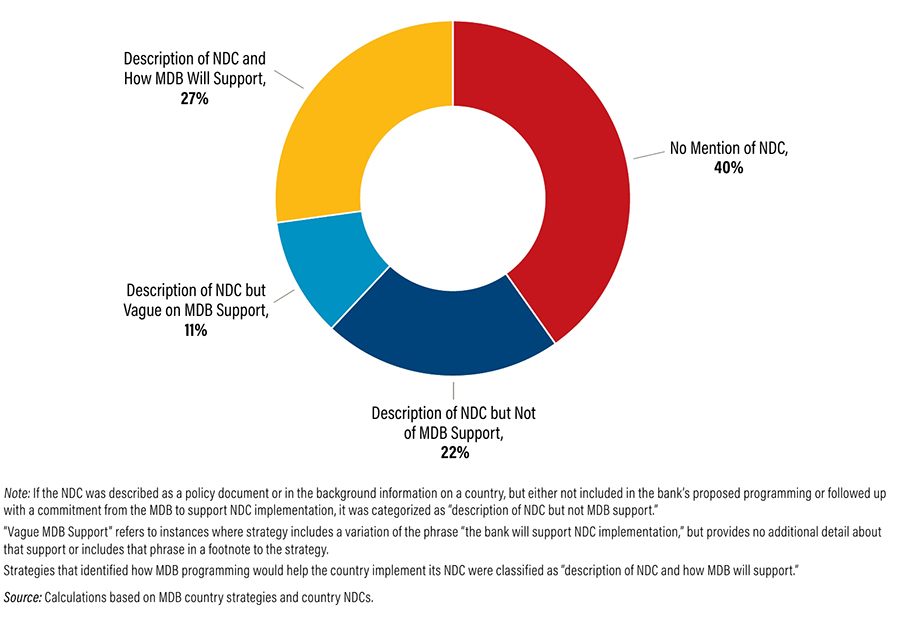

Nationally Determined Contributions (NDCs) outline each country’s contribution to reaching global climate goals, and so are central to the Paris Agreement. Current NDCs vary in their ambition levels and the degree to which they align with other government policies, plans, and regulations. Taken together, the NDCs don’t yet add up to the greenhouse gas reductions necessary to reach the global temperature goal—creating what some have called the “emissions gap.” Developing countries now need help financing, implementing, and enhancing their commitments.

While the first round of NDCs is not perfect, MDBs are uniquely positioned to help countries implement and ramp up their commitments. Several MDBs now have technical assistance programs focused on the NDCs, but these programs remain small in terms of budget and number of countries supported. Those MDBs that create country investment strategies together with their clients have started to integrate NDCs, but more is needed (see Figure). It is time for the MDBs to make sure that countries’ NDCs become a standard part of investment decision-making and policy dialogues, and that they avoid investments that may lock in low-ambition development pathways.

NDC Mentions in MDB Country Strategies (2016-2017)

4. Ensure transparency on Paris Alignment

Transparency is a central part of the Paris Agreement. Countries have committed to being open about their progress toward implementing the Agreement. Institutions like the MDBs should follow suit.

The MDBs have made great strides in disclosing how much they invest in climate-related activities. So far, however, they have been less transparent about whether and how they ensure that all investments are consistent with the climate goals. For example, the MDBs report jointly on how much they spend on renewable energy, but not how much they invest in the oil and gas sector. The MDBs should work together to make it easier to understand and compare where MDB investments are going.

The MDBs will remain key financial engines to propel global efforts to meet the Paris goals. They have made important progress to date by adopting a climate finance paradigm. But this approach is not enough if we are to limit global warming below dangerous levels. The recent MDB announcement on Paris alignment was thus a crucial step forward. Now is the time to operationalize this commitment in a way that truly ensures that all their investments are consistent with the sustainable and resilient development the world needs.

[1] Paris Agreement Article 2.1(a)

[2] IPCC Special Report.

Contacts:

Gaia Larsen, Caitlin Smith, Lutz Weischer, Sophie Bartosch, Hanna Fekete and Aki Kachi