Foundations play a vital role in addressing the climate crisis, not only through their grant-making but also via the investment strategies of their endowments. As climate change increasingly jeopardises long-term economic and social stability, foundations have both a fiduciary duty and a mission-aligned imperative to integrate climate considerations into their portfolios. Yet, most foundations have not developed coherent, climate-aligned investment strategies and often rely on vague or non-binding sustainability principles.

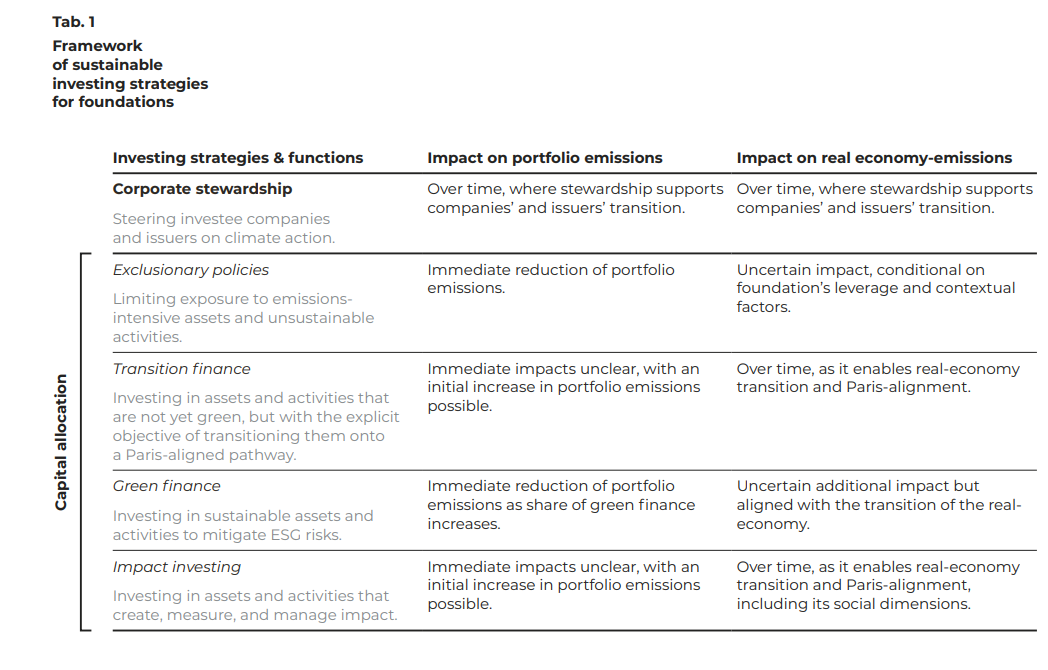

This report provides a framework to support foundations in navigating sustainable investing. It introduces a range of capital allocation and stewardship strategies and evaluates them not only by their impact on portfolio emissions but, importantly, by their potential to drive real-economy decarbonisation. Table 1 provides an overview of these strategies, their function, as well as their impact on portfolio emissions and real-economy decarbonisation / transition.

The report underscores that cutting portfolio emissions does not automatically translate into real-world climate impact. Achieving meaningful progress requires investing in ways that actively support the transformation of the broader economy, even if that means staying invested in high-emissions sectors for now. Many of these sectors are essential but difficult to decarbonise and abandoning them too early risks slowing the transition. Additionally, in areas where climate investments are still seen as too risky or low-return, public finance will be critical to attract private capital and close the investment gap.

Given their collective asset size and public-benefit mandates, foundations have both the means and responsibility to act. Strategic use of the tools outlined in Table 1 allows foundations to move beyond risk mitigation toward actively shaping climate outcomes through their endowments. The report offers practical guidance for tailoring investment approaches across asset classes and organisational capacities, highlighting that no single instrument is sufficient alone, but that a well-considered mix of stewardship and capital allocation strategies can significantly enhance both climate alignment and societal impact.