In order for development finance institutions, including multilateral development banks and bilateral, regional and national development banks to “align” themselves with the Paris Agreement, they must make sure that their activities conducted through financial intermediaries are also aligned. It is important for intermediated finance to align with overall temperature and resiliency objectives both in terms of direct but also indirect impact. In addition, development finance institutions should conduct due diligence to ensure that intermediaries meet transparency and governance requirements on an institutional level track implementation and compliance. This working paper written by Germanwatch, NewClimate Institute and WRI provides input into ongoing discussion of Paris consistency and alignment of financial flows according to the Agreement’s Article 2.1c.

Main findings:

- Development finance institutions (DFIs) play a key role in achieving the Paris Agreement’s goal of aligning financial flows with low-emission, climate-resilient development pathways. Many DFIs have committed to aligning their investments with the objectives of the Paris Agreement.

- To date, efforts to align DFI investments have primarily focused on direct project financing. However, most DFIs channel substantial portions of their finance through financial intermediaries. To be fully aligned with global climate goals, DFIs must also align these “indirect” investments.

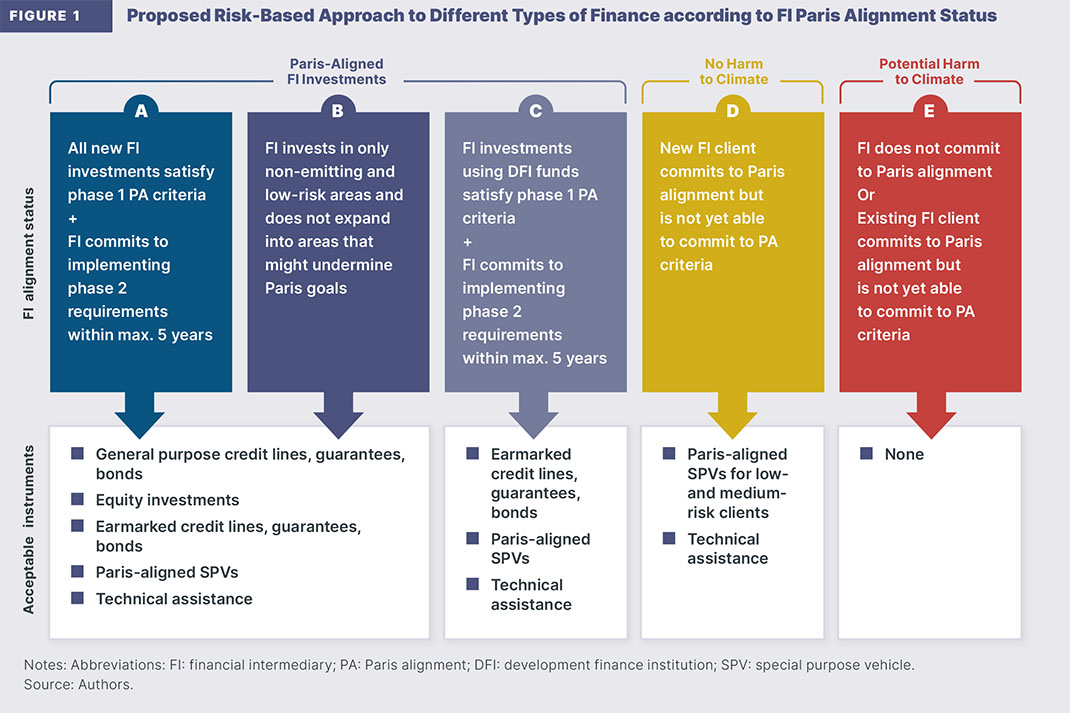

- We propose a phased approach for aligning indirect investments that includes both subproject-level criteria reflecting mitigation and adaptation requirements and institutional-level criteria related to climate governance and transparency in financial intermediaries (Figure 1).

- Ultimately, DFIs are responsible for ensuring that their intermediated investments are aligned with climate goals. We conclude with recommendations for how DFIs can align these investments through institutional changes within the DFI and a risk-tailored approach to choosing investment instruments.