This new report explores the potential of seven innovative climate finance options to meet the financing needs of the Adaptation Fund. It concludes that if implemented in a collective manner, these can provide a steady and predictable stream of finance for the Fund. However, the Adaptation Fund Board needs to proactively engage with relevant decision makers, following a dynamic resource mobilisation strategy. Potential engagement pathways for each option are discussed as well.

The publication is authored by NewClimate Institute and Germanwatch and supported by the International Climate Initiative (IKI).

Background

The Adaptation Fund has emerged as an important agent in the multilateral adaptation finance landscape and has funded over USD 357.5 mln in 63 countries in the past five years. Demand for the Fund is high and rising. Over 20 new project submissions were received in the last Adaptation Fund Board meeting despite its revenue uncertainties. COP 22 also saw willingness among countries to carve a role for the climate fund under the Paris Agreement. However, the Fund has been facing severe funding challenges after its primary revenue stream of innovative finance from CDM share of proceeds dried up. The near- and medium-term funding needs of the Adaptation Fund are estimated to be in the order of USD 130 million annually, only to run its national programmes.

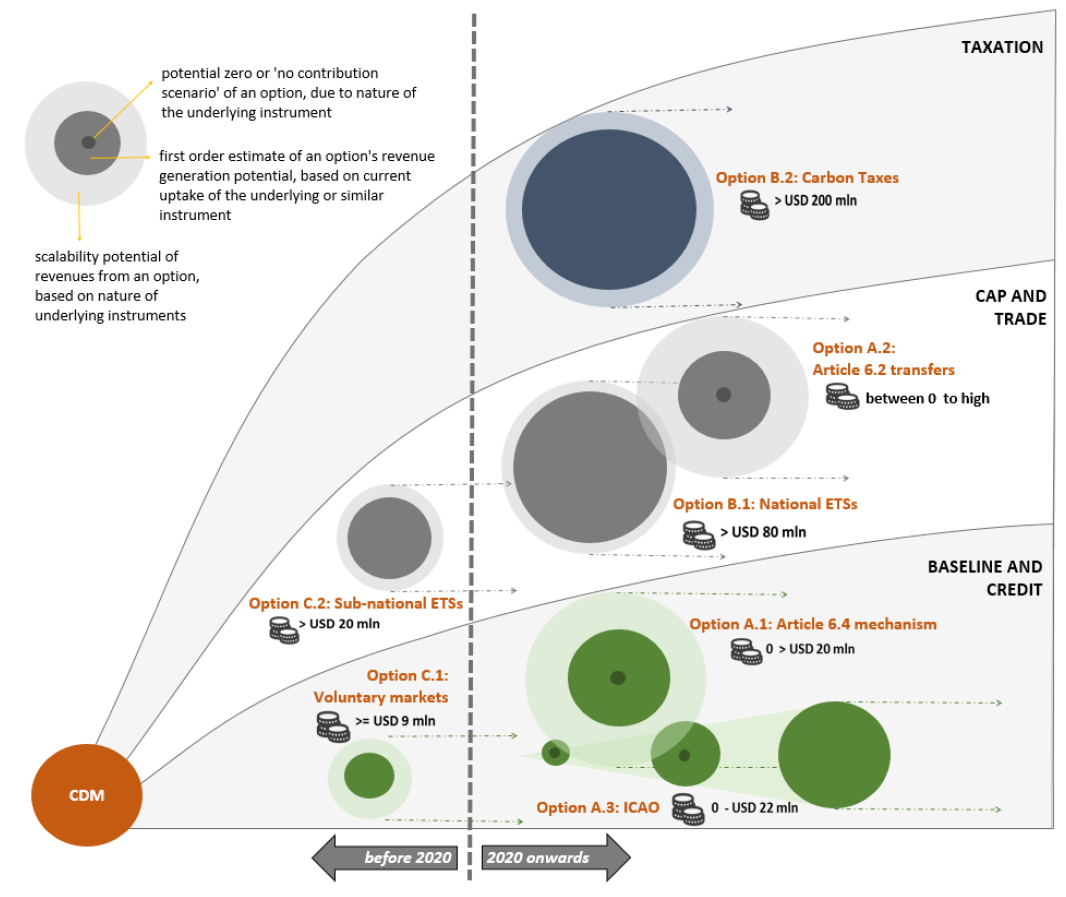

Against this backdrop, this study followed the history and experiences of the CDM levy and assessed options deriving from different carbon pricing instruments and approaches using a qualitative multi-criteria assessment framework.

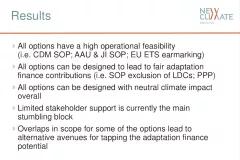

Results

The assessment highlights that from a technical standpoint, all options have a high operational feasibility. Options perform variously on their finance performance due to differences in the underlying instruments. However, all can be designed to lead to fair adaptation finance contributions and neutral impact on the mitigation potential of their underlying instrument overall. Limited stakeholder support is currently the main stumbling block.

Overall, multiple innovative finance sources must be targeted instead of one. This increases the predictability of overall revenues available and decreases future risks of funding gaps. Most obvious are offsetting approaches following the CDM precedent, followed by trading instruments and taxation approaches. The infographic above visualises the different options, implementation pathways and potential overlap between them.

The study recommends the Adaptation Fund to follow a dynamic resource mobilisation strategy with a vision of establishing a global norm of adaptation SOPs from carbon pricing instruments - a ‘2% campaign’. To this effect, the fund should engage with all or most of the options presented in this study while some options offer entry points to create role models with upscaling potential in other options.